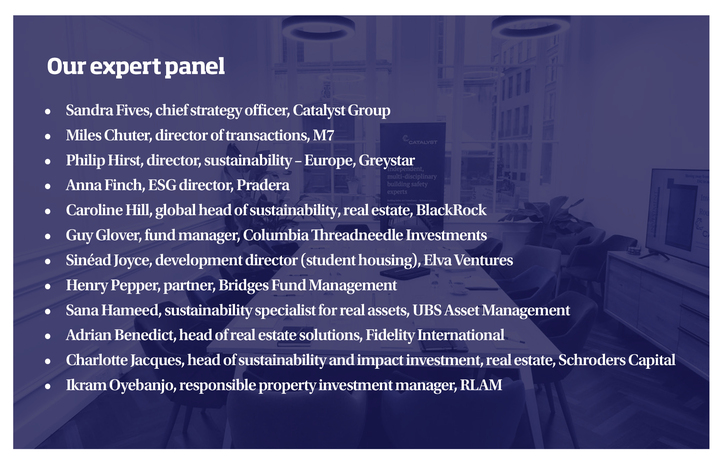

In a recent roundtable hosted by Investment Week and Catalyst Group, experts in property and sustainability investment shared views on how ESG can shift from being viewed as a compliance cost to adding value to real estate funds, including on transactions and mitigating regulatory risks.

At a time when the industry is under renewed pressure to demonstrate the value of ESG and sustainable investing, the panellists were keen to demonstrate these considerations should be ‘business as usual’ practices when managing and buying a building.

They also explored how data can help demonstrate value in the property fund space, including discussing how to cut through to what matters to investors, as well as the dangers of “over‑quantifying” the impact on individuals’ lives.

Value-add

Framing the discussion, Sandra Fives, chief strategy officer at Catalyst Group, began by observing that sustainability or ESG has been recently viewed too much through the lens of compliance and regulation, when “the core is around risk management, resilience, and value‑add, so creating that business case for your asset”.

She also highlighted the importance of ‘doing the right thing’ when this aligns with corporate values.

“It is interesting to have a narrative behind this and distinguish between your value‑add-driven sustainability initiatives and those you do because you know it is the right thing and want to drive as a business,” Fives commented.

Columbia Threadneedle Investments’ fund manager Guy Glover said his team has thought about ESG as an opportunity for many years, rather than as a threat in terms of cost or compliance.

“This is not only to align with investors’ values and what they expect, but also in the delivery of interventions. When we install a solar panel on a building we achieve an 8% income return, secure cheaper electricity for our occupiers and deliver a better valuation yield – why would you not do it?” he said.

Henry Pepper, partner at Bridges Fund Management, commented that investing in sustainable assets is what the group sets out to do from an impact perspective, but in lockstep with returns.

“If you have lower energy costs and a more efficient building, that goes straight to the bottom line – the net operating income (NOI) – so that is immediately value‑add. We do see that lockstep of value and sustainability.”

Reflected in valuations

The panellists then discussed the importance of their actions and progress on sustainability being reflected in valuations.

Miles Chuter, M7’s director of transactions, said the group is finding significant opportunities in acquiring buildings that currently fall short of compliance standards.

“We are spending a great deal of time, especially in Europe, evaluating assets where sellers may not fully recognise the compliance risks. We take properties generally viewed as value-add opportunities and reinvest in them to create institutional-grade assets that, ideally, benefit from a valuation uplift once the improvements are complete.”

However, the panellists agreed more work was needed at industry level to see progress consistently being reflected in valuations.

Anna Finch, Pradera’s ESG director, said: “The industry needs to come together and work with valuers to make sure all our efforts to decarbonise assets should be reflected in the value, because that is the key factor investors want to see.”

RLAM’s Ikram Oyebanjo, responsible property investment manager, noted The Royal Institution of Chartered Surveyors (RICS) recently closed its consultation on ESG and valuations, with a view to revising the red book.

“Valuation is inherently backward-looking, because its focus is on reflecting the market rather than leading it. ESG, on the other hand, is forward-looking. The challenge is finding a way to bridge the gap between the two.”

Philip Hirst, director, sustainability – Europe at Greystar, highlighted the relevance of the green premium/brown discount concept here.

“From a residential perspective, we know from customer satisfaction and rent data that residents prefer more efficient buildings. In residential, it is a bit easier to prove the green premium, but it can be harder for other asset classes.”

Caroline Hill, global head of sustainability, real estate at BlackRock, said there is an important difference between talking about price and value.

“Valuers are there to give a valuation and not a price. We are talking about a new definition, not of what prime is but what quality is. Quality investments in real estate are about buildings that deliver what the occupier needs, including green considerations. Those are now being – and should be – hard‑coded as normal, intrinsic fundamentals of buildings.”

She added there is an opportunity for sustainability groups to start talking about traditional real estate, and not keep treating sustainability as a separate piece. In most places, people are putting this into their business as usual (BAU) practices in terms of how they manage and buy a building.

Transactions

The panel also explored how focusing on sustainability and ESG can add value through the transaction process.

Catalyst’s Fives said more players – especially those on the institutional side – will have checklists around ESG requirements, and assets will only be considered if they meet those criteria.

“Making sure you understand the minimum requirements for the target group you are looking at can allow you to have better liquidity for your asset,” she said.

She noted the group has seen a direct link between providing transparent and good quality sustainability and ESG data and speeding up the sales process, as well as an impact on the fundraising side.

BlackRock’s Hill agreed sustainability is critical in terms of transactions, when opportunities and risks need to be considered.

“You need to be aware of what you are buying and have an appropriate sustainability capex plan to get the asset where needed for your sustainability goals. Looking beyond that, if you are repositioning an asset, what is the sustainability play? What is the opportunity?”

She said it is also important at an early stage to think about the nuances between different types of funds a particular acquisition is going into.

“Is it a core fund where you are going to be holding it for the long-term? Is it a value‑added fund where it is more of a quicker turnaround? How does that influence what you are able to do during your period of ownership?”

RLAM’s Oyebanjo said her team has a database to track non‑consumption‑level ESG data across all its managed assets.

“For each sector, we have introduced a gamified approach with weighted ESG factors to reflect their relative importance. This allows us to rank assets within their respective sectors Then you start to think: what can I do to improve the ESG credentials of this building?”

Cutting through the data

The evolving role of data in the real estate valuation process played a key part in the discussion, especially what actually matters to investors.

Adrian Benedict, Fidelity International’s head of real estate solutions, commented: “In this environment of sustainable investing, we have plenty of data, so how are we going to place a value on it? Can you put a euro or sterling valuation on that data that is going to drive pricing?”

He said this will drive back to decision-making as investment committees understand that, while they do not understand specific property ratings.

“That is probably where we as an industry can make quite considerable steps,” he added.

Pradera’s Finch said that the industry should work towards quantifying how the BREEAM framework (focused on measuring a building’s sustainability performance), and Energy Performance Certificates (EPCs), could be reflected in the value or potentially the price.

The panellists then gave examples of how sustainability performance can already be directly related to commercial and rental value.

For example, Greystar’s Hirst highlighted the link between value and sustainability in the Netherlands, where there is a points‑based system for residential rents based on EPCs.

However, Columbia Threadneedle’s Glover said he takes a wider view as interventions should go beyond mere collecting and (over) analysing data as many actual interventions are BAU or common sense and sometimes you have to follow your beliefs.

He explained: “Seven years ago, when I put living wage clauses in my leases, that was done to effect change, not because I could quantify it. I want my cleaners or security teams in buildings to be paid the right amount, and it is the right thing to do by society. I believe that you do not need to quantify some of the choices, and sometimes waiting for data holds up simple interventions and progressing the agenda.”

The panel discussed how investors would respond to this approach, as more data is produced and pressures mount to quantify progress.

Glover questioned what all this data means to end investors as “feedback from investors is that they are increasingly bamboozled because of a lack of standardisation between providers”.

“We have to go beyond just data and seeking to prove value to delivering on the agenda,” he said. “The more powerful stories are those that deliver real impact on the ground, because that resonates with investors, whereas data points often do not.”

Charlotte Jacques, head of sustainability and impact investment, real estate at Schroders Capital, added: “We have to work as an industry and say: ‘This is what matters. This is how we can show you we are doing the right thing, and it financially makes sense, as well as helping societal change.”

Data difficulties

The panel highlighted current difficulties getting the ESG data they need, particularly from tenants in certain countries or sectors.

Schroders’ Jacques said: “How are we addressing the fact that we do not have whole building actual data? We are all having to extrapolate or benchmark, so we need some common standards.”

Bridges’ Pepper noted the group is now designing living buildings with smart metering, which provides a huge amount of operational data, which will massively move forward with AI and technology to continue to evolve and drive performance.

Fidelity’s Benedict also observed that AI is helping to fill the data gaps and there are going to be solutions for how the industry mines, interprets and utilises that data.

However, Sinead Joyce, Elva Ventures’ development director (student housing), highlighted the importance of having access to that data in a “useable fashion”.

“I have met with general managers on site who have not had access to the right portals to use this kind of data to make a meaningful difference locally and on the ground, so there is some work to be done,” she said.

Regulatory impact

The panellists then talked about how regulation is evolving in relation to sustainability and real estate funds and the potential impact on property portfolios.

Sana Hameed, sustainability specialist for real assets at UBS Asset Management, noted the increasing regulatory focus on addressing data challenges and establishing consistent standards.

“There is a regulatory recognition of the data inconsistencies and the need for common applicable standards.”

“Regulators are taking steps to tackle these challenges through measures such as the EU EPBD, which aims to harmonise the EPC definitions across the EU member states. The EC’s upcoming overhaul of the SFDR (2.0) is expected to introduce asset-class specific requirements e.g., principal adverse indicators that are customised for real estate, rather than the generic metrics. But how these changes will look in practice remains to be seen.”

Catalyst’s Fives then shared her views on the impact of the new Energy Performance of Buildings Directive (EPBD), with integration at national level needed by May 2026.

“Once it is delivered, the ratings of each building are likely to change. It is creating a lot of risk when you consider a portfolio to understand: will I still maintain the same position or am I going down and potentially have issues in rental?’

In terms of preparing for EPBD implementation, Fives said the best thing to do is work on EPCs as a good management basis from the start.

“If you do that and drive performance throughout your building, the EPBD impact will, hopefully, be less on your portfolio,” she said.

RLAM’s Oyebanjo explained her team has reassessed every one of its buildings over the past two years in response to changing regulations.

“You can be proactive and strategic with when you reassess under the new methodologies, and then you can start building that into your capex plan, so you know what that future position looks like,” she said.

The potential impact of the regulations on certain sectors and regions was also highlighted by the panel. Bridges’ Pepper said there could be some specific examples where, in a drive for energy efficiency and insulation on buildings, you could get residential overheating.

Greystar’s Hirst said the risks are potentially more by country rather than asset class, as there is the reality of EPCs in the building stock in each country.

“What is the national average in Spain versus Germany versus the UK? When you are a global or European investor, you have your eye on the standard system of wanting an A or a B, but a B could be only 1% of the stock in a particular country, so it is phenomenal for that country but maybe fares less well when you look at it regionally. It is going to be key to work out both the regional or global view, but also the country‑specific view.”

BlackRock’s Hill highlighted the huge misperception about EPCs, especially by an occupier, is they tell you how a building is performing, when they are actually a forecast.

She said the industry needs to look at actual performance, which is where frameworks like the National Australian Built Environment Rating System (NABERS) standards are “really exciting”.

Schroders’ Jacques said the UK has been thinking about moving towards these for some time as it uses the voluntary NABERS UK system, but regulation would probably be needed to increase uptake.

“That is exactly what we need,” she said. “Otherwise, we are just playing with theoretical concepts and not really getting to grips with the reality of in-use energy efficiency and carbon efficiency.”

Wishlist for the property sector

Finally, the panel highlighted what they would like to see now from the wider industry as sustainability continues to evolve in the real estate space.

Catalyst’s Fives identified the need for simplification and standardisation of ESG practices, while also observing the best impact is when clients customise initiatives and look at what makes sense given a building’s characteristics.

“Benchmarking is great, as it gives you a high‑brush view on what you should prioritise and target, but customisation in an industry that is becoming more and more sophisticated on sustainability will be increasingly required. I see it as the next steps.”

Columbia Threadneedle Investments’ Glover said he would like more focus on the “really important” social side and the industry can go the next step beyond just data collection and report writing to a person-centred approach in improving individuals’ lives.

“That is a real opportunity we can embed in our teams’ thinking, and there are great outcomes for everyone, including investors,” he said.

RLAM’s Oyebanjo added if you are a long‑term investor, you need to start thinking about the connection between the local community and the viability of your assets.

“It is long‑term income protection, as that is the future working population of that asset, who are the future spenders for your retail assets, or workforce for your industrial/office assets etc.

“Social considerations often come up in planning, it just needs to go a bit beyond. There are so many opportunities and the thing with ESG, or sustainability in general, is it is so intersectional.”

The panellists discussed what investors want from social investments, with Finch highlighting there is no perfect methodology to prove your social value.

“The social aspect is tangible and intangible; it depends on who you talk to. When you speak to investors, they sometimes want to see how that social value is reflected in their assets. In terms of standardised methodology, it is not there yet.”

However, Glover said it is dangerous to quantify everything as costs and investors appreciate stories about the impact they are having.

“You do not have to forego any of the financial return by progressing the ESG agenda. We all have a strong belief that by doing the right thing it is accretive to your overall financial return. If the wider team know they are doing good, as well as doing well, end of story – it is embedded into your investment philosophy and approach.”

Schroders’ Jacques added: “It comes down to the purpose of that investment. What is the ambition and purpose that investor has and how do they want to allocate their capital into society? Some of that is quantifiable and some is not: we need both.

“Social is now a new alternative asset class, where we are recognising the benefit of bringing institutional capital into these types of schemes.”

Catalyst’s ESG consultants work with investment managers on ESG strategy, regulatory requirements and asset-level performance. The team helps organisations assess compliance and climate risks, value-add and efficiency opportunities, and plan practical actions at fund and asset level to drive value and futureproofing.

Read the full article here