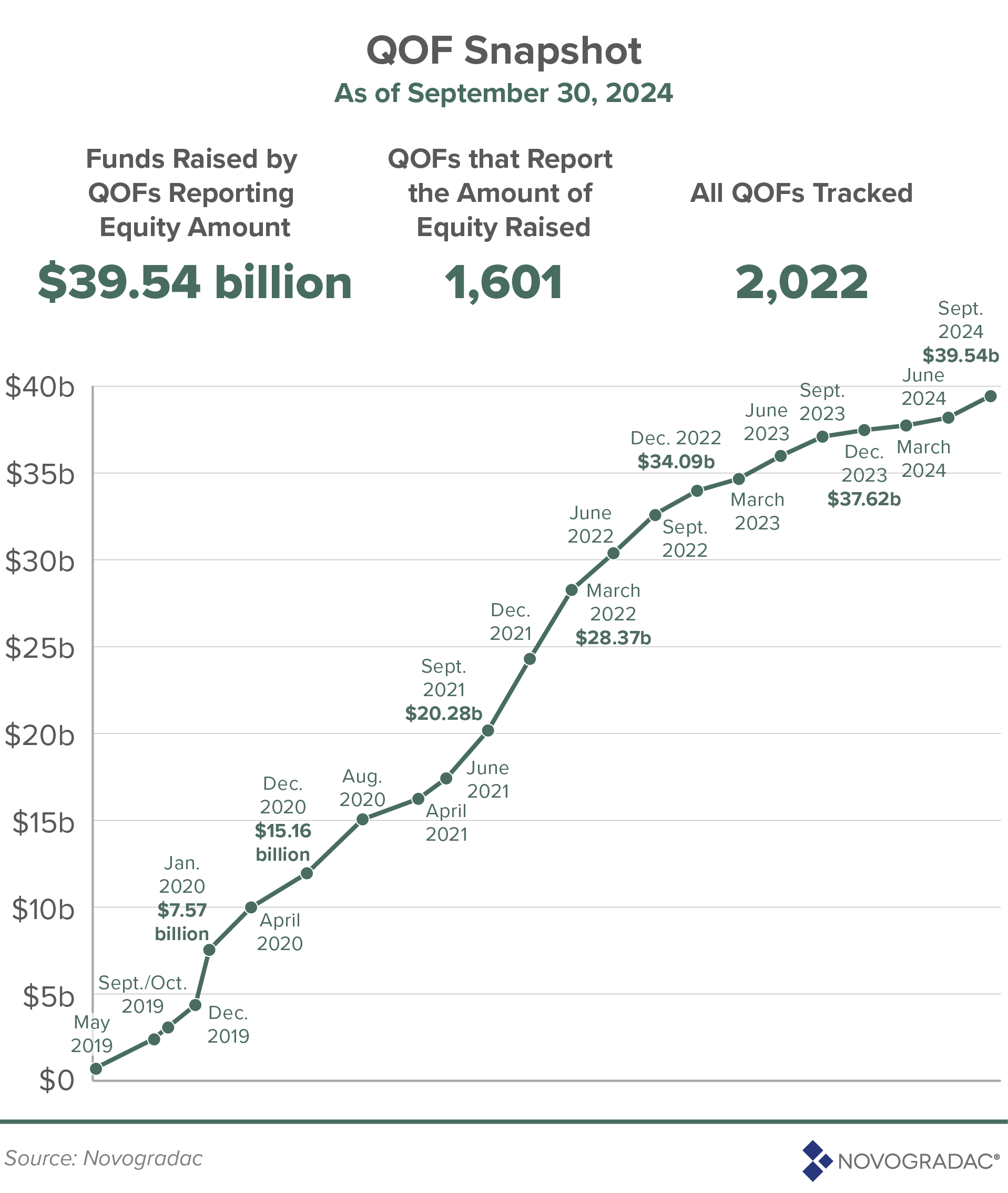

Qualified opportunity zone funds tracked by Novogradac – a certified public accounting, valuation, and consulting organization – reported a significant surge in investment during the third quarter of 2024. The funds raised $1.24 billion in additional capital, bringing the total investment since the inception of the opportunity zones incentive to $39.54 billion.

This quarter-over-quarter growth represents the largest increase since the second quarter of 2023 and surpasses the combined total of the previous three quarters. The momentum suggests that the 2,022 qualified opportunity funds tracked by Novogradac will likely exceed $40 billion in equity raised by the end of the year.

Of the 2,022 funds, 1,601 report the amount of equity raised.

Of the 2,022 funds, 1,601 report the amount of equity raised.

Key Findings from Novogradac’s Q3 2024 Report

- Residential investment dominates: A significant portion of QOF investments, approximately $23.65 billion, is allocated to residential properties, with a strong focus on multifamily housing.

- Top investment cities: Nashville, Tenn.; Washington, D.C.; Cleveland; Phoenix; and Austin, Texas, are leading cities in terms of the number of housing units financed by qualified opportunity funds. The top state for planned opportunity zone investment is California.

- Diverse investment landscape: Qualified opportunity funds are investing in various sectors, including commercial ($3.64 billion), hospitality ($1.04 billion), clean energy ($1.33 billion), and operating businesses ($306 million). Each category has higher amounts when including mixed-use investment, according to Novogradac, topped by $8.68 billion invested in properties that combine residential and commercial elements.

- Strategic fund management: While most qualified opportunity fund managers oversee a single fund (76.9%), those managing multiple funds have raised a substantial portion, 45%, of the total equity. There are six qualified opportunity fund managers who oversee more than $1 billion in equity raised.

Novogradac’s third-quarter data appears to underscore the popularity and impact of qualified opportunity zone funds. Although the qualified opportunity zones program has been questioned since inception, The DI Wire believes it is poised for growth during Donald Trump’s second term.

Click here to visit The DI Wire directory page.

Read the full article here