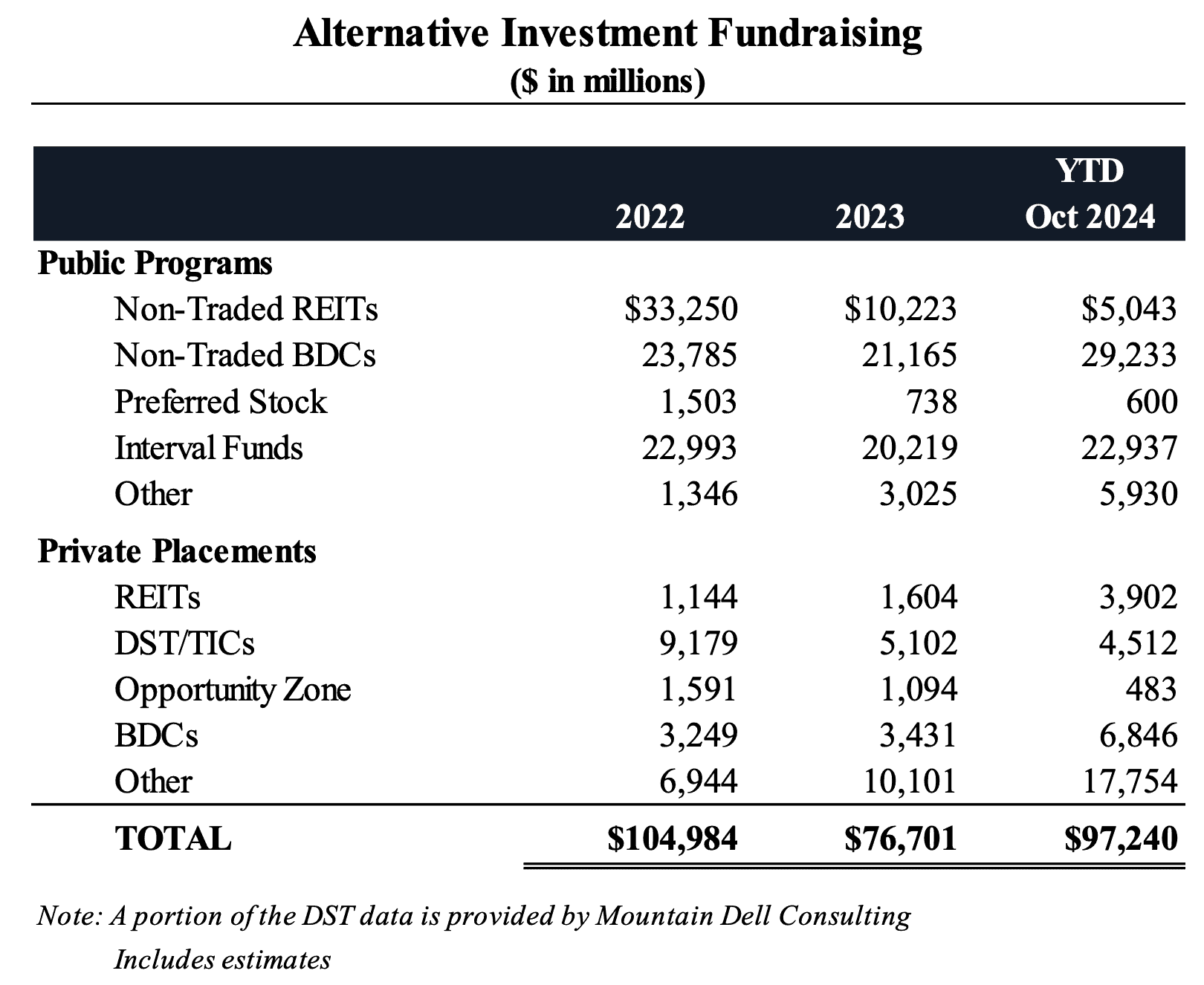

Alternative Investment fundraising totaled approximately $97.2 billion through October, led by non-traded business development companies at an estimated $29.2 billion, interval funds at an estimated $22.9 billion, other private placements (including infrastructure and private equity offerings) at $17.8 billion, and private BDCs at $6.8 billion. This is according to the latest analysis by investment banking firm Robert A. Stanger & Co., Inc.

Stanger said public non-traded BDC fundraising is up nearly 82% as compared to this time last year while non-traded real estate investment trust fundraising is down 47%, respectively.

“We are increasing our estimate of fundraising in alternative investments by retail investors from $115 billion up to $120 billion in 2024. Investors have already committed a staggering $36 billion into BDCs and $9 billion into public and private REITs this year,” said Kevin T. Gannon, chairman of Robert A. Stanger & Co., Inc.

Stanger’s survey of top sponsors tracks fundraising of all alternative investments offered via the retail pipeline including publicly registered non-traded REITs, non-traded BDCs, interval funds, non-traded preferred stocks, Delaware statutory trusts, opportunity zone funds, private BDCs, private REITs, and other private placement offerings.

The top fundraisers in the alternative investment space year-to-date are Blackstone ($14.4 billion), Cliffwater ($11.1 billion), Blue Owl Capital ($10.4 billion), Ares Management Corporation ($8.4 billion), and Kohlberg Kravis Roberts & Co. ($8 billion).

Private placement offerings of net asset value REITs, BDCs, infrastructure, and private equity investments continue to gain traction in 2024. Additionally, several new private offerings from companies such as Blackstone, Coller Capital, Eagle Point, New Mountain and Principal are anticipated to launch and break escrow in 2025. Kohlberg Kravis Roberts & Co. leads in overall private placement fundraising year-to-date with nearly $7.7 billion, followed by Blue Owl with $4.8 billion, Blackstone ($3.7 billion), Ares Management Corporation ($3 billion), and Goldman Sachs ($2.6 billion) rounding out the list of top five private placement fundraising sponsors.

Private placement offerings of net asset value REITs, BDCs, infrastructure, and private equity investments continue to gain traction in 2024. Additionally, several new private offerings from companies such as Blackstone, Coller Capital, Eagle Point, New Mountain and Principal are anticipated to launch and break escrow in 2025. Kohlberg Kravis Roberts & Co. leads in overall private placement fundraising year-to-date with nearly $7.7 billion, followed by Blue Owl with $4.8 billion, Blackstone ($3.7 billion), Ares Management Corporation ($3 billion), and Goldman Sachs ($2.6 billion) rounding out the list of top five private placement fundraising sponsors.

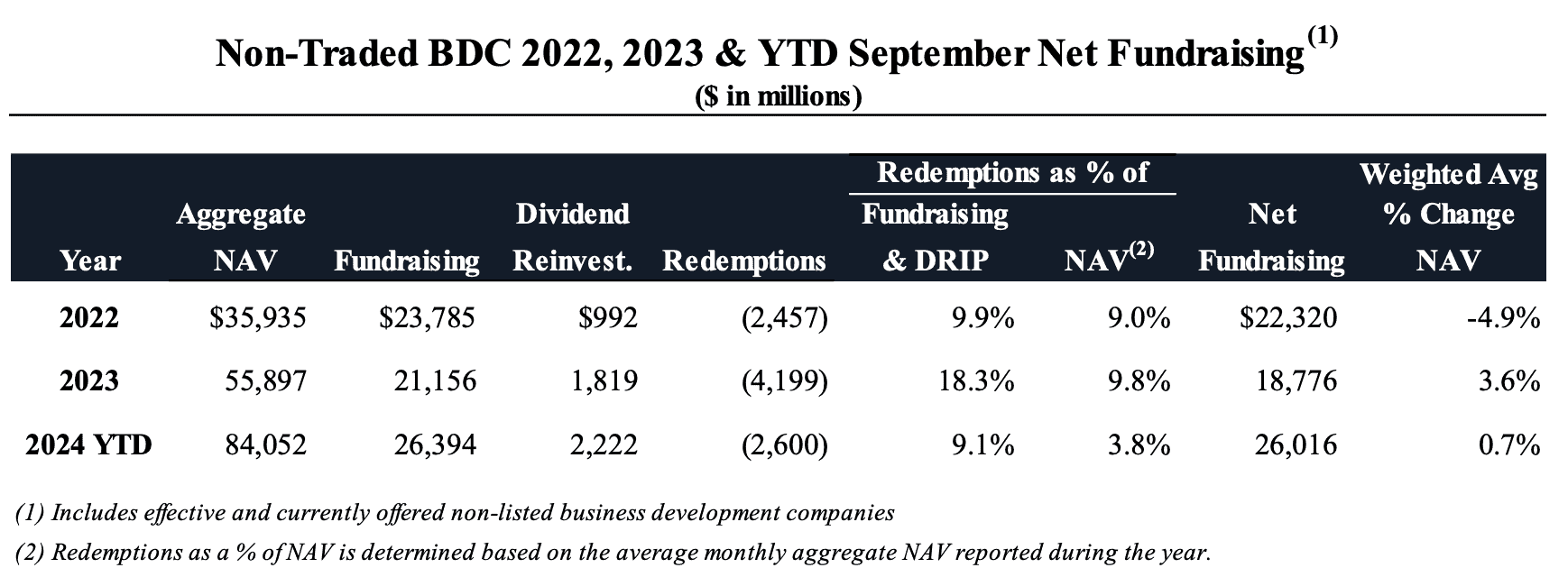

Through the third quarter of 2024, effective and currently offered non-traded BDC companies reported nearly $26.4 billion of fundraising with an additional $2.8 billion raised in October to bring the year-to-date total past $29 billion raised.

“In terms of net fundraising levels, non-listed BDCs have held up much better than NAV REITs due to the generally higher average dividend levels of nearly 10.6% versus 5.9% in NAV REITs,” said Randy Sweetman, executive managing director of Robert A. Stanger & Co., Inc.

As of Sept. 30, 2024, effective and currently offered non-traded BDCs had a combined aggregate NAV of approximately $84.1 billion, a year-over-year increase of nearly 72%.

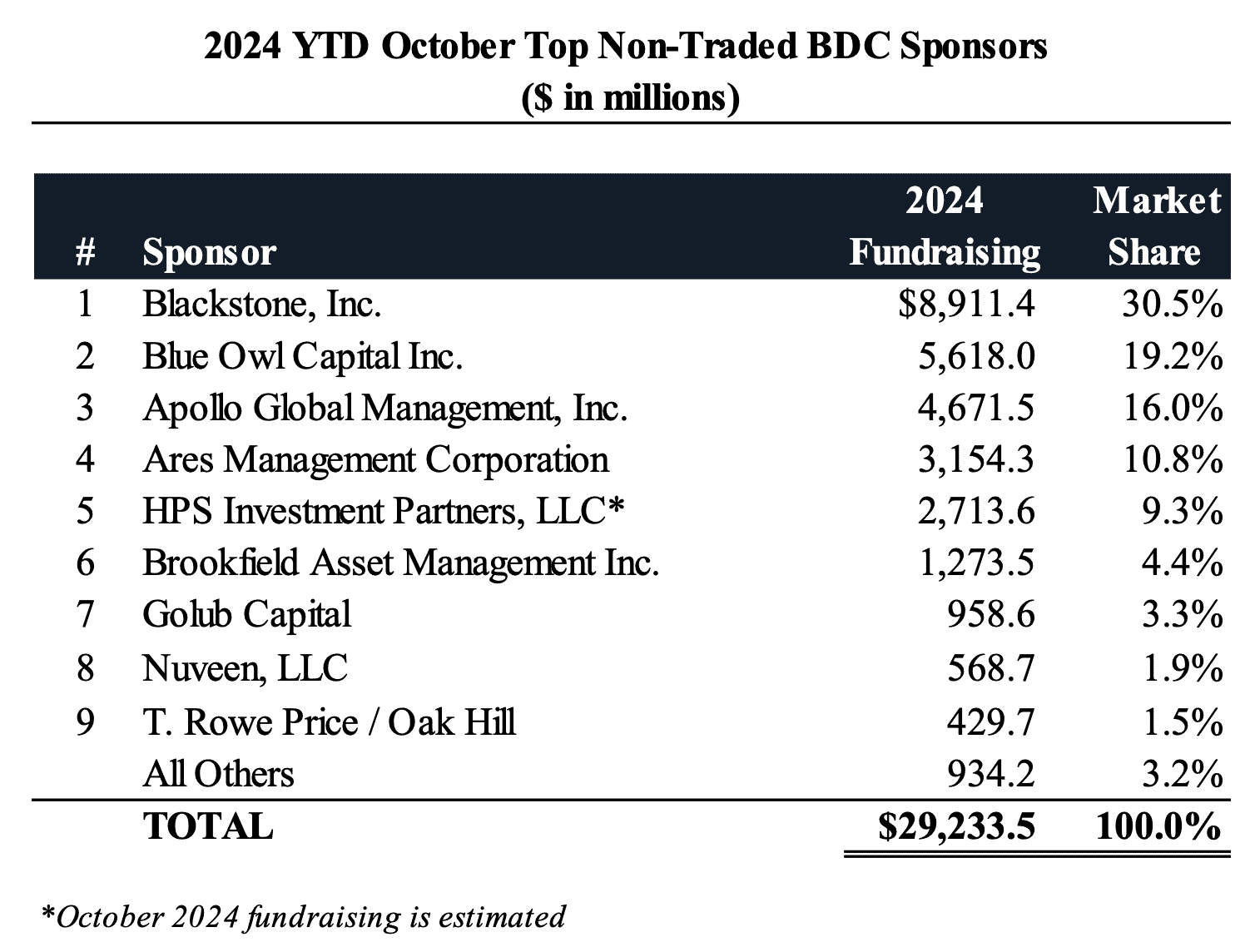

Blackstone leads non-traded BDC fundraising year-to-date with nearly $8.9 billion raised, followed by Blue Owl Capital with $5.6 billion, Apollo Global Management ($4.7 billion), Ares Management Corporation ($3.2 billion), and HPS Investment Partners (estimated $2.7 billion) rounding out the list of top five fundraising sponsors. Stanger expects that fundraising in public non-traded BDCs will continue its blistering pace for the remainder of the year and projects the full-year total to reach $35 billion raised.

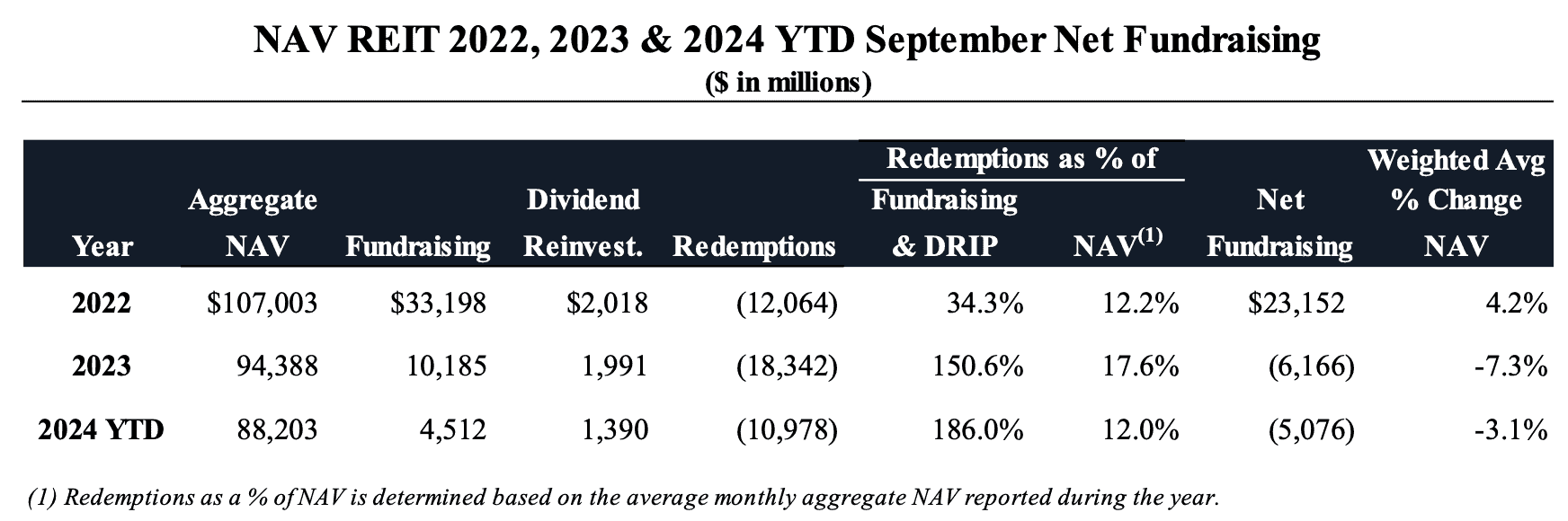

Non-traded NAV REITs have reported third quarter investor redemption results that show considerable signs of easing. Overall redemptions are down 43% from the prior quarter and down 21% from the same time last year.

“We are starting to see a reduction in the NAV REIT redemption queues that built up over the last two years, particularly with Blackstone’s BREIT satisfying all investor requests and returning $1.7 billion to investors in the third quarter as compared to the $3 billion per quarter going back to the third quarter of 2022,” said Gannon.

NAV REIT redemptions through the third quarter totaled nearly $11 billion as compared to $14 billion at the same time last year. Additionally, non-traded NAV REITs reported nearly $4.5 billion in fundraising through the third quarter with an additional $500 million raised in October to bring the year-to-date total past $5 billion raised. As of Oct. 31, non-traded NAV REITs had a combined aggregate net asset value of approximately $88.3 billion, a year-over-year decrease of nearly 11%.

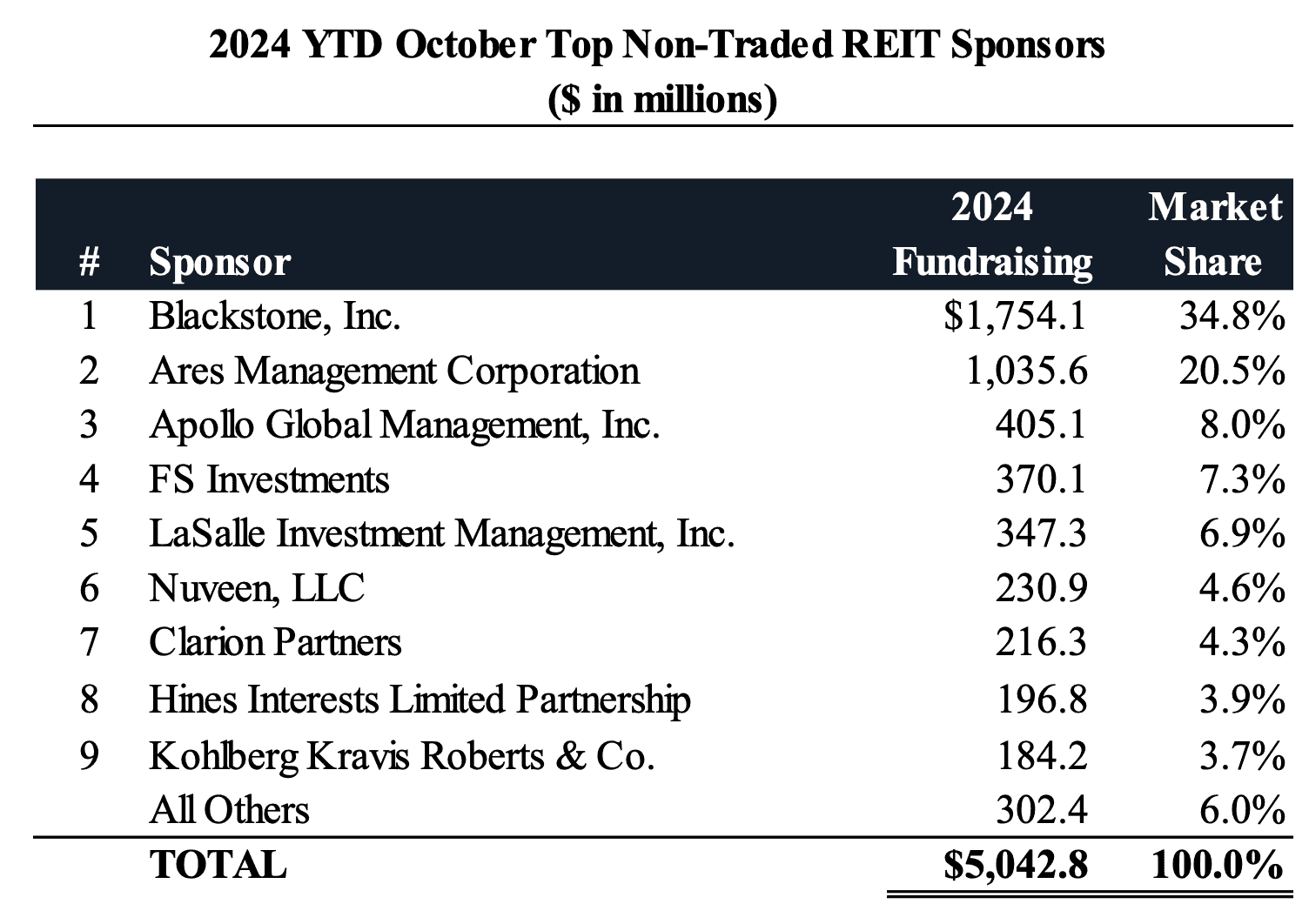

Blackstone leads non-traded REIT fundraising year-to-date with nearly $1.7 billion raised, followed by Ares Management Corporation with $1 billion, Apollo Global Management ($405.1 million), FS Investments ($370.1 million), and LaSalle Investment Management ($347.3 million) rounding out the list of top five fundraising sponsors.

Stanger expects that fundraising in public non-traded REITs will remain muted for the remainder of the year as private placement REITs gain in popularity.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.

Click here to visit The DI Wire directory page.

Read the full article here