Tate’s plan to secure its future by building an endowment fund worth £150m by 2030 has sparked debate in the UK museum sector about whether such a funding model could sustain national and regional institutions long-term.

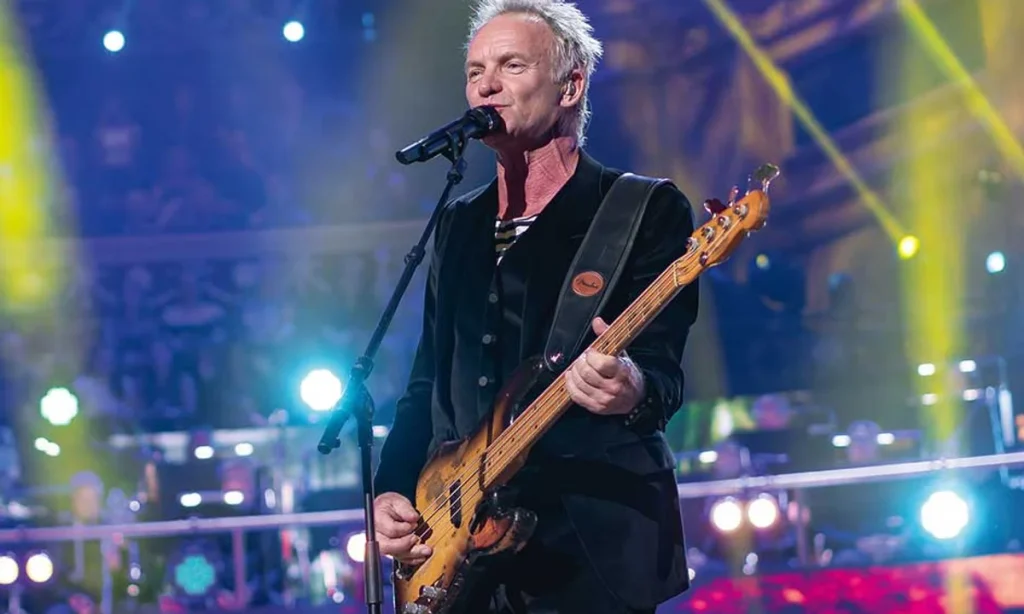

Endowments are less widespread in the UK than in the US, where the top 45 museums hold such funds worth more than $40bn in aggregate, according to UpStart Co-Lab figures. But Tate was not the only UK institution to set up an endowment in June—in an unusual move for a regional gallery, Baltic Centre for Contemporary Art in Gateshead also launched a £10m fund, kickstarted with a “major donation” from the musician Sting.

Other UK museums have quietly operated such funds for some time: the Victoria and Albert Museum benefits from a £10m endowment held by the Gilbert Trust for the Arts that finances the periodic refurbishment of the Gilbert Galleries. The British Museum has almost £50m in endowments, according to its 2025 annual report.

“At a time of declining public investment in the sector and a challenging environment for fundraising, cultural institutions facing financial strain are inevitably looking at alternative funding models,” says Paul Hobson, the director of Modern Art Oxford. “The endowment model is attractive because of the perceived long-term self-sufficiency it assures.”

In June, Tate launched its Tate Future Fund with a lavish gala in the Turbine Hall of Tate Modern, which raised more than £1m. The new fund has so far received donations worth more than £43m. “We look forward to making further announcements in due course,” a spokesperson for Tate says.

Museum endowments have the support of the UK government department for culture, media and sport (DCMS). “We support increasing philanthropy across the arts and cultural sector, and endowments are one way organisations can support their long-term financial positions,” a DCMS spokesperson says, stressing that all fundraising decisions are taken by trustees, independently of government.

Sarah Munro, the director of Baltic, says that its endowment plan has been “an ambition for Baltic for some time, and we began seriously planning this 18 months ago. We hope it will inspire other arts organisations who have not yet considered endowments.”

Asked if Baltic’s current funding model—its core funders include Gateshead Council and Arts Council England—is inadequate, she says: “There is always more to do and the need to have more funds to do it, but the endowment fund allows us greater scope to continue to deliver an even more creative and radical programme.” All donations are subject to ethics policies, she adds.

Income from the endowment will go towards specific areas such as “a commitment to free entry”, its artistic programme which is “depleting year on year due to rising costs” and community programmes such as North East Young Dads and Lads, which helps young men and fathers.

Advantages

The principle of an endowment is to create a capital sum which is protected; museums subsequently only draw on the interest each year. Tate Future Fund will “always be dedicated to the artistic creativity of the organisation and the public benefit”, Balshaw says; the endowment funds will be ringfenced for research and scholarship.

If successful, endowments can unlock independence, financial resilience, and the ability to plan for the long-term, says Paula Orrell, the national director of Contemporary Visual Arts Network England. Government funding for visual arts has stagnated for over a decade, and the current economic climate is intensifying pressures on institutions, she adds.

“Regional museums and galleries are being forced to seek alternative models of support to sustain their programmes and infrastructure,” she says. “Baltic is a case in point; it is increasingly looking to its patrons for support, and like others, considering how endowments might offer long-term security.”

Alarm bells

Some museum and fundraising professionals warn that adopting this model will require a change in how UK institutions approach fundraising. In comparison with the US, the UK lacks a culture of large-scale philanthropic giving to the arts, Orrell says.

Tate can draw on its extensive network of donors. Some of its trustees are contributors to the new fund, including Roland Rudd, the board chair; Nick Clarry, the managing partner at the private equity firm CVC Capital Partners; and Jack Kirkland, the founder of the grant-giving charity the Ampersand Foundation.

But Hobson says that for organisations already struggling to balance their budgets, “it is difficult to see from what sources endowments might be raised, especially given the current exodus of individual high net-worth philanthropists post-Brexit and the government’s latest ‘non-dom’ tax rules, which are driving many of our most generous cultural philanthropists to leave the United Kingdom.”

A museum fundraising consultant who asked not to be identified by name says the Tate’s path “may not be a great strategy for smaller arts organisations in the UK”.

The Baltic in Gateshead aims to secure its future with a £10m fund, an unusual move for a regional gallery

Photo: artdolgov/Adobe Stock

“Donors like to give to things where they can see the difference and be involved,” hesays. “Endowment is funding for the future and long-term sustainability; you need a lot of money for an endowment to generate enough return in the future to contribute to income needs. Big donations are just not that easy to come by for most organisations in the UK; also endowment fundraising can undermine revenue or capital fundraising. Most organisations need money now.”

Past experience

Catalyst Endowments, a £36m match-funding initiative, offered UK heritage organisations the opportunity to create an endowment; the scheme, backed by Arts Council England, was launched in 2012 and wound down in 2017.

“Twenty of the 31 grantee organisations achieved their fundraising target and so claimed 100% of the matched funding,” said a 2017 report from the University of Kent.

“We still benefit from this [Catalyst scheme] each year,” a spokesperson for Dulwich Picture Gallery says. “We will now be focused on increasing our endowment as our running costs have increased far beyond inflation in the last decade.”