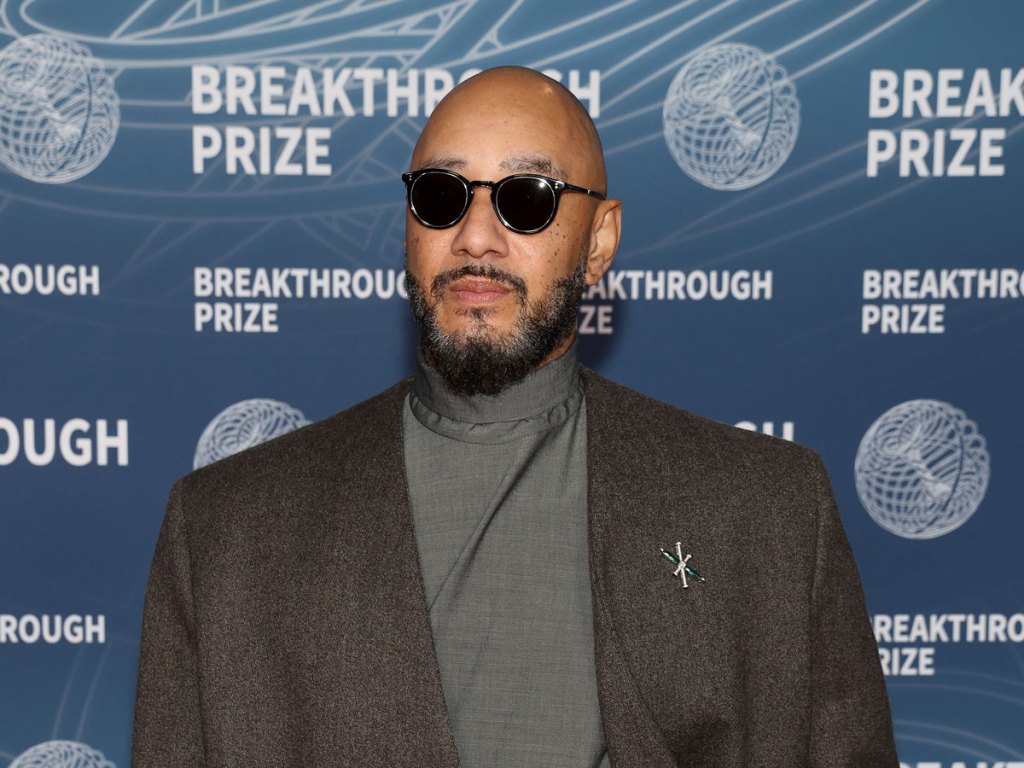

A federal judge has ruled that music producer and top collector Kasseem Dean, who is better known as “Swizz Beatz,” must remain a defendant in a bankruptcy case related to the high-profile 1MBD scandal. The suit will now head to the discovery portion of the proceedings.

In February, Dean filed a motion to dismiss himself and two companies solely owned by Dean (Monza Studiosand Swizz Beatz Productions) as defendants in the case, which was first filed against Dean and the two companies in October 2024 in US District Court for the Southern District of New York.

Among the legal arguments presented in the motion to dismiss are a “lack of standing to bring the asserted claims” on the part of the plaintiffs, that the alleged counts have exceeded the statute of limitations, and that the plaintiffs have not pleaded enough facts to state the claim in their suit, as well as request for a dismissal with prejudice. “[E]ach of the claims asserted by the Liquidators are fatally flawed,” the defendant’s motion to dismiss reads.

That motion adds, “The [plaintiffs] present this action under the noble premise of recovering assets for the benefit of creditors. In reality, the lawsuit is being used as a bad faith vehicle to pressure the collection of legally, non-recoverable assets by embarrassing, in the [plaintiffs’] own words, a ‘notable record producer.’”

On September 26, Judge Naomi Reice Buchwald issued a ruling denying the motion to dismiss and stating that the plaintiffs’ claims “are not time-barred,” that the plaintiffs “have standing to bring their claims and that the Court has subject-matter jurisdiction to hear them,” and “pleaded specific facts supporting an inference of actual fraudulent intent.”

The plaintiffs in the case are Angela Barkhouse and Toni Shukla, who are serving as joint liquidators for four companies, labeled as “Insolvent Entities” in the ruling. The plaintiffs’ suit alleges two counts of fraudulent conveyance and one count of unjust enrichment.

In an email to ARTnews, Casey D. Laffey, an attorney representing the plaintiffs, said, “We are pleased with this well-reasoned and thorough decision. The funds should be returned so that our clients can rightfully discharge their obligation to return the funds to Malaysia’s sovereign wealth funds, and ultimately the people of Malaysia. We look forward to moving this case forward to discovery and on the merits.”

Attorneys representing Dean and his companies did not reply to ARTnews’s request for comment.

According to the judge’s ruling, which provides a summary of the plaintiffs’ complaint, Dean was a friend of Low Taek Jho (also known as Jho Low), who allegedly “masterminded the now-infamous $7.65 billon fraud … against the 1 Malaysia Development Berhad [1MDB] sovereign wealth fund.”

The plaintiffs seek to recover $7.3 million that was transferred Affinity Equity International Partners Limited and Alsen Chance Holdings Limited, two companies that were at one point controlled by Low, to Dean and his companies.

The ruling continues, “The alleged fraudulent transfers in this case concern a small portion of the transactions comprising the larger 1MDB Fraud.” Judge Reice Buchwald adds that the current suit does not allege that “Dean was a participant in the 1MDB Fraud beyond his alleged receipt of fraudulently obtained funds.”

The funds received by Dean and his companies were allegedly part of two bond issuances, each valued at $1.75 billion, that were earmarked for 1MDB to purchase a power production company (“Project Magnolia”) and to acquire energy assets (“Project Maximum”).

But, the ruling states, “[n]either the Project Magnolia nor the Project Maximus funds made their way to their intended destinations.” Some of these funds would allegedly make their way to Dean and his companies via various shell companies at the order of Low or his associates, according to the ruling.

Judge Reice Buchwald’s ruling provides tables that detail these alleged transactions, which occurred between 2012 and 2017 and allegedly originated from a 1MDB fund to Dean or his companies. These tables allege that Dean received a total of $2.2 million; Monza Studios received a total of $1.8 million; and Swizz Beatz Productions received a total $1.5 million.

The ruling also reveals that Dean was also the owner of a work that the US Department of Justice had previously recovered as part of the 1MDB, Andy Warhol’s Round Jackie (1964), which Low had allegedly gifted to Dean in 2014. Dean handed over the work in 2020. In 2024, the DOJ recovered several works related to the 1MDB, including a Warhol and Monet from Low and a Picasso from 1MDB’s former general counsel. Earlier this month, the US Marshals conducted an auction of works by Picasso, Basquiat, and other artists connected to the 1MBD scandal, which netted $36 million.