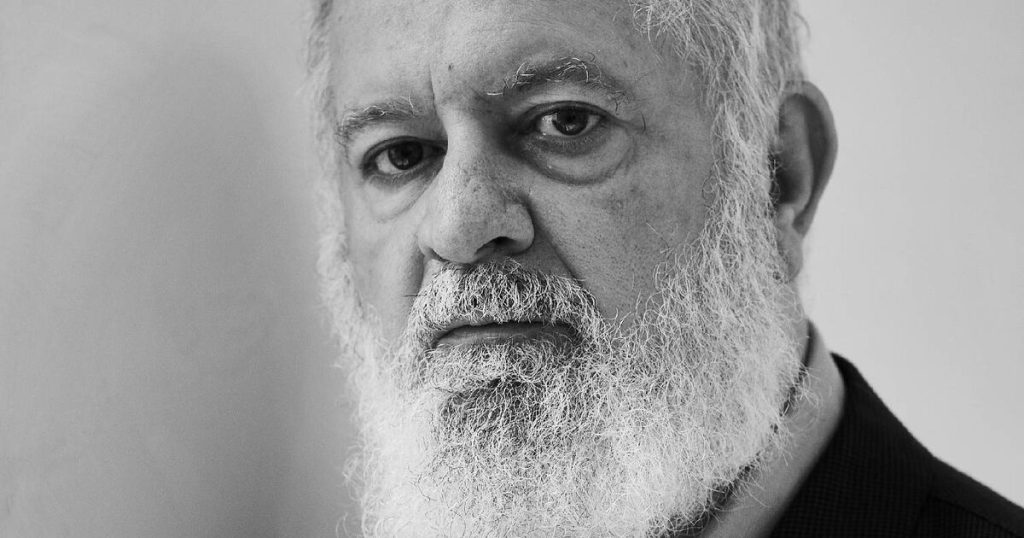

Portrait of Massimo De Carlo. Photo by Pasquale Abbattista. Courtesy of Massimo De Carlo.

It was only October, but Massimo De Carlo, founder of the gallery named after him, was already reflecting on how the year had gone. “2025 was a resetting year,” he said. After what he calls a “bad” 2024, the eminent dealer has spent recent months fine-tuning how his gallery operates to be “less dependent on the volatility of the market and the volatility of relationships.” The real verdict, he argued, will come in 2026, when it should be clearer whether the market challenges are structural or “occasional.” Are collectors totally recalibrating their buying behaviors, or is the recent slowdown a cyclical dip?

It is a typically pragmatic stance from the dry-humored dealer who, in the almost four decades since founding his gallery, has watched the art market pendulum swing with as much speed as the fortunes of his beloved soccer team, AC Milan. Since he founded his Milan gallery in 1987—after a detour through pharmacy studies and an early love of avant‑garde music—De Carlo has witnessed the art market undergo several permutations. One of Italy’s most influential art dealers, De Carlo represents more than 60 artists, including Maurizio Cattelan (who famously taped him to a wall in 1999) and Rudolf Stingel. His gallery now operates branches in Hong Kong, London, Paris, and an office in Seoul, as well as its original location in Milan.

Exterior view of MASSIMODECARLO Milan. Photo by Delfino Sisto Legnani and Marco Cappelletti Courtesy of MASSIMODECARLO.

For De Carlo, part of the current recalibration in the market is cultural. The trade grew used to “easy years,” he noted, and “lost…the perception that the art market is capricious.” His gallery’s answer has been to tighten ties with those who matter most: artists, collectors, and institutions. The more those relationships are cultivated, he said, the less the business is buffeted by “volatility.”

This effort is not about rethinking the gallery’s ethos, which is marked by a familial atmosphere. “We were never a corporate gallery,” he said, noting that artists were the key to his business. He used the analogy of publishers, where “the brand is made by the writers.” Today, he combines decades‑long artist relationships with a restless curiosity for new talent, with young names such as Diane Dal-Pra and Ludovic Nkoth joining the gallery in recent years. “Everything we did, we did for the artists,” he said.

This extends to the gallery’s approach to programming. Each exhibition should be a “specific experience,” he said. He points to the range of shows in the London gallery, which occupies a charming floor of an 18th-century Mayfair townhouse. Recently, the gallery has mounted a refined Peter Halley presentation, before switching tack completely to showcase work by the young painter Lenz Geerk: an apt demonstration of the variety in its program.

De Carlo also likes to switch things up in his other galleries. In Paris, the gallery’s storefront—Pièce Unique—acts like a street‑level vitrine. Although there was originally a brick wall facing the street, the architect Kengo Kuma refitted it with a single sheet of glass, collapsing the threshold between city and gallery, turning a small room into a public moment. “It’s like a niche into the street where you can see art,” he said. In October, the space was the subject of much chatter during Art Basel Paris, when it opened Scandi artist duo Elmgreen & Dragset’s October 2025 (2025), a striking, hyperrealistic, life-size sculpture of a gallery assistant slumped forward over a large desk. “Gallery spaces can influence the possibilities of a show,” De Carlo said. “The gallery in that moment is a kind of producer.”

Elmgreen & Dragset, exterior view of “October 2025” at MASSIMODECARLO Pièce Unique. Photo by Thomas Lannes. Courtesy of MASSIMODECARLO.

The gallery’s precise approach to artists and programming has been a constant throughout the art market’s twists and turns. Today, De Carlo believes the market is becoming “more serious, with collectors and trends that are less hysterical.” Practically, that means less speculation and more time for collectors to consider purchases. His preferred indicator of success is “more artworks that go directly from the wall of the gallery to the wall of the houses of the collectors,” rather than into storage. Before COVID, he said, too many pieces disappeared into warehouses. If the current market cycle is slower but more deliberate, it could be healthy, aligning commercial interest with the conviction and desire to live with art.

But the future is also dependent on the economy, which will have to create the right conditions “to support our vision and the vision of the audience.” De Carlo described himself as a “well‑informed pessimist,” not because he expects the worst, but because the only approach is to see risk clearly and keep moving. “I always say that a pessimistic person is an optimist with a lot of information,” he said.

Jennifer Guidi, installation view of “Points on Your Journey” at MASSIMODECARLO Milan, 2025. Photo by Roberto Marossi. Courtesy of MASSIMODECARLO.

His view of Milan, the city that formed him, illustrates this realism. The city’s advantage, he says, is its cultural density: design, fashion, food, and a surprising concentration of institutions and private foundations—Fondazione Trussardi, Fondazione Prada, the Triennale Design Museum, the Pirelli HangarBicocca—within a bikeable radius. “The concentration of all those things makes the city very exciting,” he said.

Yet he doesn’t expect the recent buzz around its art scene—with new galleries opening and wealthy residents drawn in by Italy’s attractive tax regime—to alter local market taste, yet. Milan is “a city that is still linked to some very old values.” He noted that many Milan collectors are most interested in 20th-century Italian artists like Lucio Fontana, Enrico Castellani, and Piero Manzoni, and movements such as Arte Povera. “It’s still a city that is not really completely connected with what’s going on in the future,” he noted. “I do not think that one or two galleries will change this, but it is important that they think that there is a possibility, and this makes Milan more attractive.”

As for the future more broadly, De Carlo sees “two landscapes:” one is “hell;” the other is “who knows what.” He paraphrased a famous quote, “Once you are in hell, go on.” “This is the exciting part of the business,” he said. “We are in a difficult situation, but we have to go on.”