Despite multiple bullish catalysts, oil prices remained stubbornly rangebound at the start of this week, with markets awaiting a notable shift in sentiment.

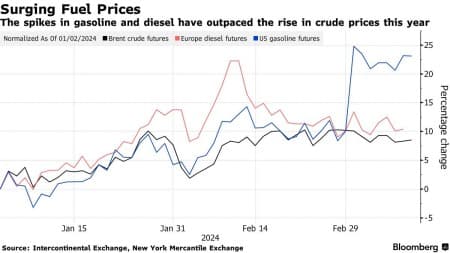

– US gasoline futures have jumped sharply in the past two weeks, up more than 20% since the beginning of the year, as Red Sea disruptions, refinery force majeure events, and resurgent demand put the heat on fuel prices.

– With US gasoline prices now 60% higher than at the time of the 2020 presidential election, the Biden administration will be looking warily at RBOB front-month futures flirting with $2.6 per gallon.

– The two main refinery additions this year, Nigeria’s 650,000 b/d Dangote and Mexico’s 340,000 b/d Dos Bocas refinery, have been plagued by delays and are unlikely to have an impact on H1 gasoline supply, increasing the possibility of potential summer spikes.

– Premium gasoline will be particularly susceptible to price rallies as the NY Harbor RBOB octane spread, gauging the cost of high-octane blendstocks, soared to the highest-ever readings in March, at $0.42 per gallon.

Market Movers

– US natural gas producer EQT Corp (NYSE:EQT) agreed to purchase pipeline operator Equitrans Midstream (NYSE:ETRN) in an all-stock deal including debt that values the company at $14 billion.

– Saudi Aramco (TADAWUL:2222) increased its dividend by 30% to $97.8 billion, despite its net profit declining almost 25% last year on lower prices and production, providing more revenue to the state.

– UK oil major BP (NYSE:BP) decided to permanently close a third of its crude distillation capacity at the 257,000 b/d Gelsenkirchen refinery in Germany from 2025 onwards.

Tuesday, March 12, 2024

Oil markets are set for a busy week, but so far neither US inflation data nor the monthly OPEC report managed to disrupt the stagnation of oil prices, with ICE Brent still trading around the $82 per barrel mark. The end of US refinery maintenance, coupled with better-than-assumed demand figures, might be one of the key trends to watch out for. At the same time, drone strikes on Russian refineries could squeeze diesel markets. The wait for a sentiment shift continues.

Saudi Arabia Cuts Heavy Supply to Asia. Saudi Aramco (TADAWUL:2222) plans to cut Arab Heavy crude supply to Asia in April, citing oilfield maintenance, explaining why the heaviest Saudi grade saw the biggest month-on-month change in formula prices, up 30 cents per barrel.

OPEC Sticks to Its Bullish 2024 Outlook. The Organization of Petroleum Exporting Countries (OPEC) said world crude demand will increase by 2.25 million b/d in 2024 and by 1.85 million b/d next year, keeping its bullish forecasts unchanged from last month and raising its GDP forecasts.

Houthis Target Red Sea Shipping Again. Maritime warfare continues in the Red Sea as Houthi rebels fired several missiles at the Liberia-flagged container ship Pinocchio, en route to the Suez Canal, claiming the hit was accurate on what they believe is an American-owned tanker.

Mexico Elections See Heated Refinery Row. Mexico’s opposition candidate Xochitl Galvez vowed to close two of Mexico’s largest refineries, Cadereyta and Madero, within six months of taking office, arguing both plants are huge air, ground, and sea polluters.

India Cannot Get Enough of Coal. India’s coal-fired electricity soared to an all-time high of 115 TWh in January, up 10% year-on-year, leading to a concurrent increase in coal-powered emissions to 104.5 million metric tonnes of CO2 as renewable output dropped lower.

Tanker Damages Port Berth in India’s Key Port. Oil tanker Hafnia Seine, carrying alkylates to the Indian port of Sikka, hit the crude import facility of Bharat Petroleum (NSE:BPCL), damaging the single point mooring that is used by BPCL to supply its landlocked Bina refinery in central India.

Gulf Oil Giants Set Sights on Lithium. Following ExxonMobil’s move into Arkansas lithium, the Middle East’s largest oil producers Saudi Aramco and ADNOC are reportedly looking at ways to extract lithium from brine in their oilfields, without specifying what direct extraction they will use.

Petrobras Loses Appeal After Axed Dividend. Shares of Brazilian national oil firm Petrobras (NYSE:PBR) dropped by 12% week-on-week after the company’s board axed a 50% extraordinary dividend, saying that $8.8 billion would be better used reinvested in company operations.

Iron Ore Weakens on Faltering China Hopes. Iron ore futures declined to their lowest since October, dropping to ¥830 per metric tonne ($115/mt) at the Dalian Commodity Exchange, amidst higher-than-expected exports – Kpler data show 150 million tonnes in January, the highest on record.

Chinese Solar Stocks Rebound After Annus Horribilis. Shares of Chinese solar companies Xinyi Solar or Flat Glass jumped this week after rumors emerged that Beijing would lift the curtailment rate for solar-generated electricity from its current 5%, boosting 2024 growth.

European Majors Want US to Deny Venture Global Extension. European energy firms Shell (LON:SHEL), Edison, Repsol, Orlen SA, and Galp Energia asked US authorities to reject Venture Global’s one-year construction permit extension, believing the firm has completed the plant but failed to provide them with contracted cargoes.

Permian Gas Prices Turn Negative, Again. Spot natural gas prices at the Waha hub in west Texas returned to negative territory this week, averaging -10 cents per mmBtu, due to a combination of mild weather, higher-than-average inventories, and still rising gas production.

Algeria Expands LNG Export Infrastructure. The first-ever large-scale LNG carrier Ougarta loaded a cargo at the Skikda liquefaction terminal in Algeria, part of the African nation’s goal to expand LNG marketing opportunities after exporting a 13-year high of 13.5 million tonnes in 2023.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

Read the full article here