Amid widespread economic weakening, due in no small measure to destructive Trump policies such as slashing and burning of Federal agencies that provide important public and business-boosting services, and supply-chain-cracking and inflation inducing tariff increases, it should hardly be a surprise that consumer and business confidence is sagging, as are Trump policy approval ratings. As we’ll review posthaste, a new naysayer, albeit in economese, is the Fed.

Donald Trump’s approval ratings are underwater across the board.

Americans don’t support how he is handling the economy, the federal work force, foreign policy, or trade.

Which, is basically everything a President does. pic.twitter.com/tKzqcAIUIJ

— Jessica Tarlov (@JessicaTarlov) March 13, 2025

BREAKING: In a stunning announcement, CNN Senior Data Analyst Harry Enten just announced Donald Trump has the lowest approval rating on handling the economy at this point in his Presidency. This is huge.pic.twitter.com/UrLUMjFmjj

— Democratic Wins Media (@DemocraticWins) March 19, 2025

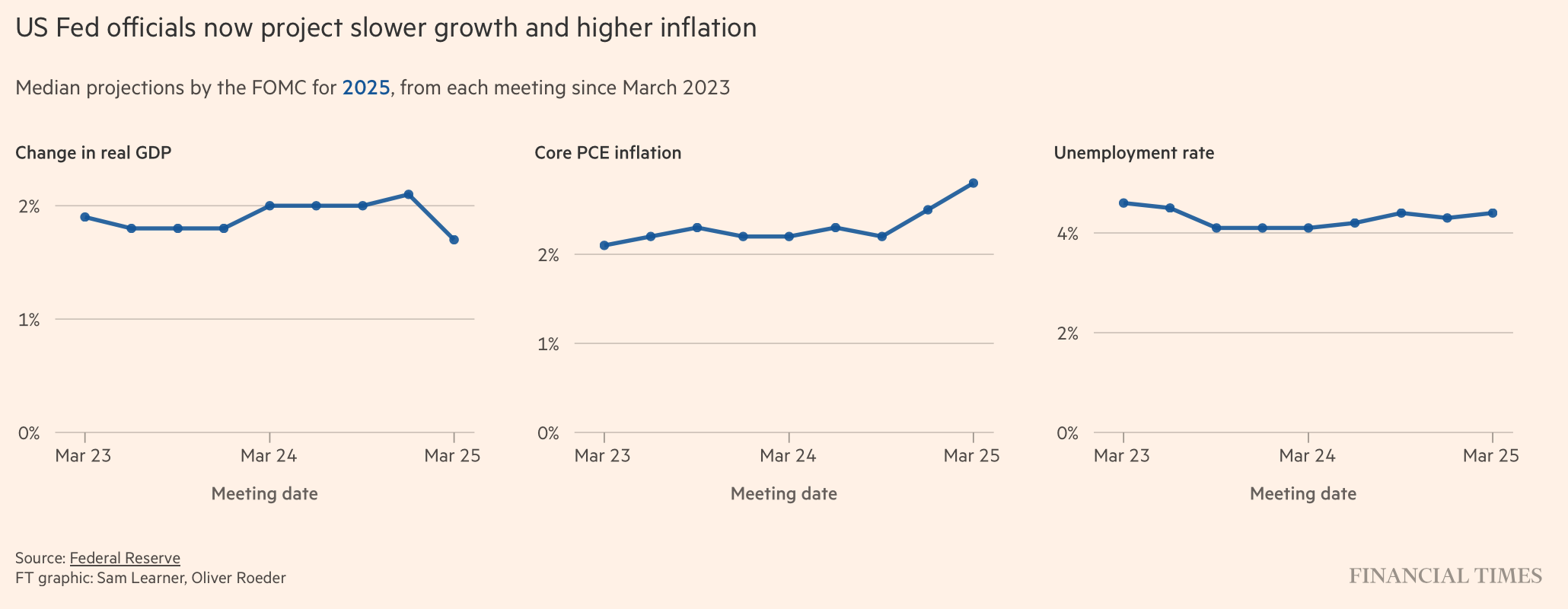

The lead story in the Wall Street Journal is Fed Projections See an Economy Dramatically Reset by Trump’s Election. The corresponding headline at the Financial Times is more direct, Federal Reserve cuts US growth forecast as Trump’s policies weigh on outlook, but the Wall Street Journal does a through job of unpacking the central bank’s, erm, reservations.

However, there’s a huge failing at the heart of the Journal story, which is not even mentioning what the actual forecasts were. For that, we have to go to the Financial Times, which appropriately puts them in the second paragraph:

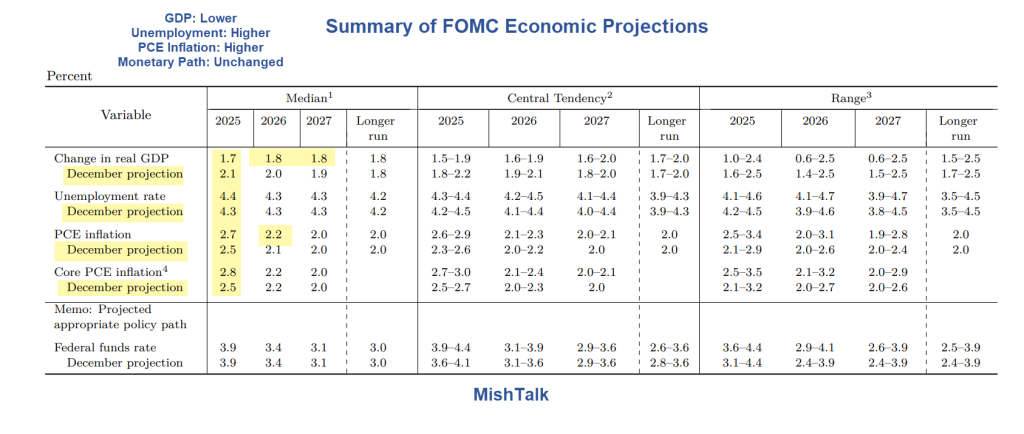

The Fed’s latest projections showed officials expected GDP to expand by 1.7 per cent this year, with prices forecast to rise by 2.7 per cent. Policymakers kept the central bank’s main interest rate on hold at the end of a two-day meeting on Wednesday.

Bloomberg gave a its TL;DR version:

The Federal Reserve left interest rates unchanged, buying time to assess how President Donald Trump’s policies impact an economy facing both lingering inflationary pressures and mounting growth concerns https://t.co/Sp5efWSkin pic.twitter.com/56OPsGnOnt

— Bloomberg TV (@BloombergTV) March 19, 2025

Michael Shedlock provided the relevant data table:

The Journal describes a sudden, hard Trump economic gear-shift, to the degree that a lot of vulnerable travelers have gotten whiplash:

The Federal Reserve’s first set of projections since Donald Trump’s inauguration underscored—in the central bank’s understated and technocratic fashion—just how much the president’s plans to press ahead with widespread tariffs have turned the economic outlook on its head.

The story continues by discussing how the soft landing scenario is out the window as tariffs will raise prices while whacking investment, the Confidence Fairy, and groaf. Moreover, the risks all look to be on the downside.

The Fed Chair just said what every credible economist, every economics textbook, and every empirical study shows: Tariffs reduce output and raise prices.

This is quite uncontroversial stuff, folks. (Also, depressing.) pic.twitter.com/h0dj05STMQ

— Justin Wolfers (@JustinWolfers) March 19, 2025

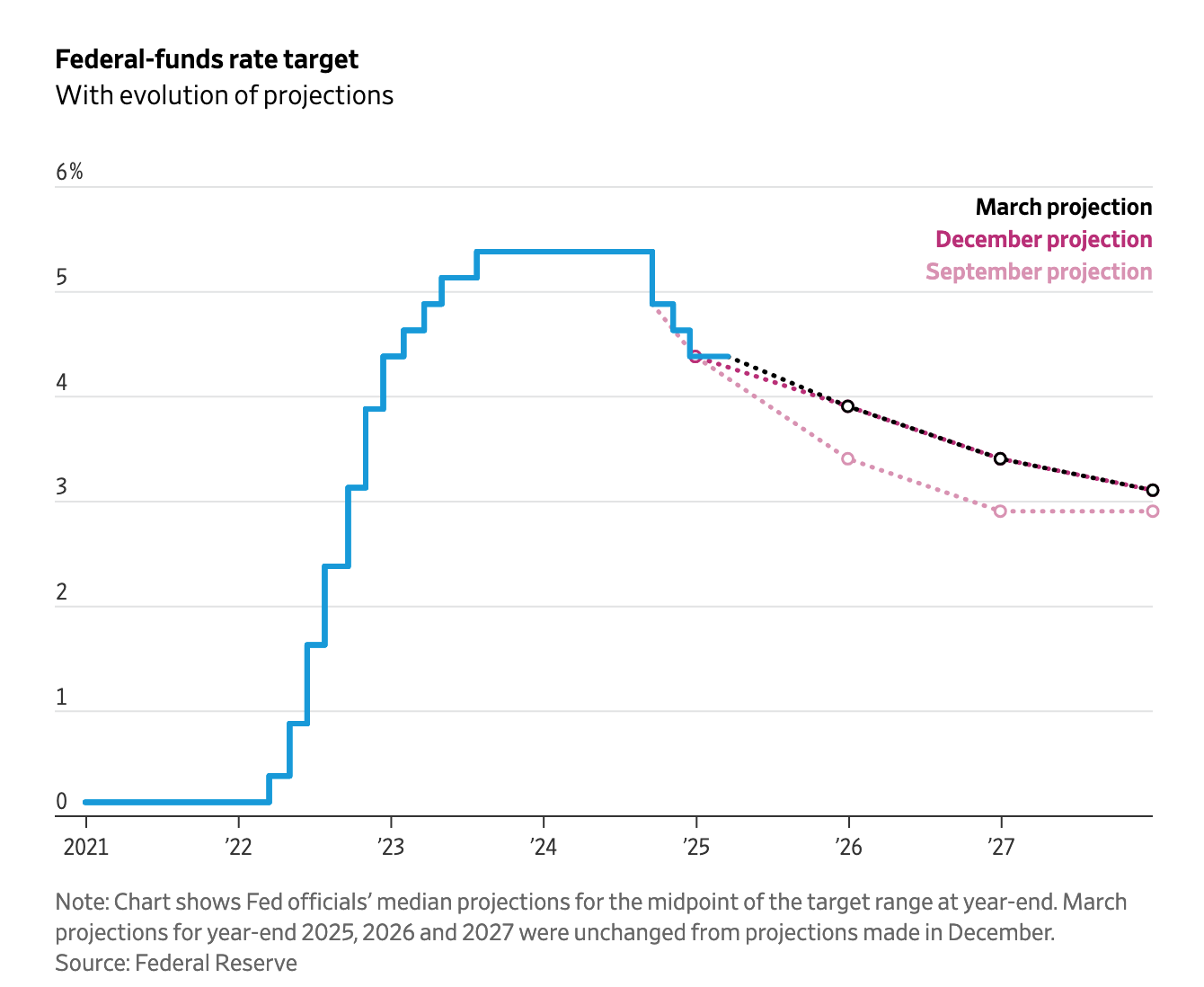

Despite all that, the central bank stuck with anticipating two rate cuts this year, which led to a bit of a stock market bounce. That came despite Fed chair Powell pointing out that there was a “level of inertia” among investors about the odds that their hoped-for rate cuts might come up short.

However, the “inertia” remark is more than a bit of projection. The Fed takes the view that any tariff-induced price increases are a temporary shock and then prices will stabilize. But the central bank’s time frames are different from those of consumers and one imagines, many businesses. Even after the prices of eggs has stabilized at an arguable new normal, buyers still remembered well when they had been cheaper, even if prices had not risen further in, say, the last six months. Keep further in mind that this phenomenon suggests that how the Fed thinks about inflation expectations (as reflected in bond market yields) are based on investor behavior, not consumer behavior, and thus could seriously misread real economy reactions.

The Journal describes that Fed officials do recognize that their usual approaches might fail given the tariffs shock:

Officials could be hard-pressed to declare price increases from tariffs as temporary if they set in motion a reordering of global production processes that takes years to play out.

On top of that, Fed officials are nervous that the postpandemic inflation might have given businesses and consumers more acceptance of higher inflation. Policymakers pay close attention to expectations of future inflation because they think those expectations can be self-fulfilling.

The Journal did use the dreaded word “stagflation” but depicted that as a possibility as opposed to a given, and further argued that even if it happened, it would not be as bad as the 1970s version.

Now to the pink paper, which provided a more urgent take:

The Federal Reserve has slashed its US growth forecast and lifted its inflation outlook, underscoring concerns that Donald Trump’s tariffs will knock the world’s biggest economy….

Progress on inflation was “probably delayed for the time being”, Powell said. The Fed has been battling to push inflation back to its 2 per cent goal and halt the most severe bout of price pressures in decades.

The Fed also announced that it was slowing down the pace of its quantitative tightening programme, lowering the amount of US Treasury debt it allows to roll off its balance sheet each month from $25bn to $5bn beginning in April.

With Trump a chaos generator, the prospects are so much in flux that one might as well throw darts….except for quickly rising alarm and widespread signs of deterioration. Readers have reported big falloffs in traffic in local stores. The Journal reported on belt-tightening at every level of the income scale. These are not portents for happy citizens or a healthy economy.