by Jack Nicastro, Reason, March 4, 2025.

Excerpt:

Empower, a ride reservation service, has been hounded by Washington, D.C., regulatorssince it began its operations in 2020. CEO Joshua Sear will be arrested on Wednesday for violating the Department of For-Hire Vehicles’ (DFHV) cease and desist order if the app doesn’t shut down by then. Mayor Muriel Bowser has the power to direct the DFHV to rescind its order, which would allow Empower to continue operating in the city.

Sear founded Empower in 2019, not as a transportation company but as a software company that serves independent professional drivers. Empower differs from the flagship ride-share services in multiple ways. Unlike Uber and Lyft, drivers who use Empower do not receive 1099 forms—they are not contractors, but customers, according to the company.

The company also does not collect a percentage of every fare, nor does it set them; its drivers set their own rates by adjusting their minimum and base fares, per minute, per mile, and surge prices as they see fit. They then pay Empower a flat monthly fee of $349.99 for access to the D.C. Monthly Platinum plan, which “provides drivers with unlimited access to Empower’s software and support services.” Empower’s suggested rates are “set so that drivers make 20% – 25% more on average than they would if they were driving on behalf of Uber/Lyft [and] riders also save 15-20% on average.”

by Liz Wolfe, Reason, March 5, 2025.

Excerpt:

“Part of the confusion comes from Social Security’s software system based on the COBOL programming language, which has a lack of date type,” reported the Associated Press last month in response to DOGE reports about improper payments. “This means that some entries with missing or incomplete birthdates will default to a reference point of more than 150 years ago.” (The agency auto-stops payments to those older than 115.) The Social Security Administration’s inspector general has admitted as much: The agency is really struggling to figure out how to “properly annotate death information in its database” per the A.P., and there are nearly 20 million Social Security numbers of people born in 1920 and earlier who haven’t been marked as dead. But Trump is conflating “not marked as dead in a database” with “received benefits”—an absolutely wild leap we have no evidence to support. In fact, the July 2023 report from the inspector general notes that “almost none of the numberholders discussed in the report currently receive SSA payments.”

by Timothy Taylor, Conversable Economist, March 5, 2025.

Excerpt:

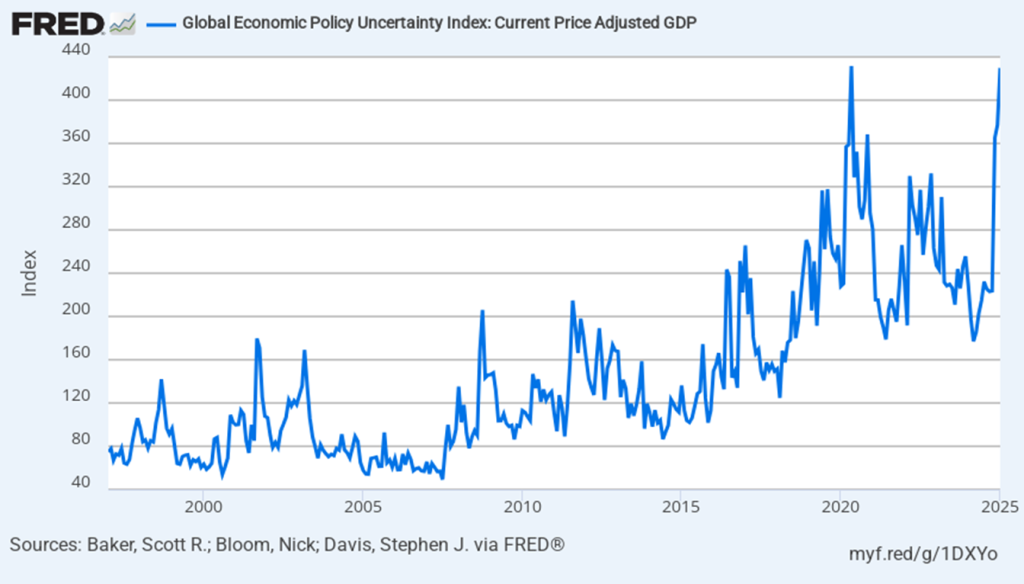

The US uncertainty index is not official government data. It is based on a method developed by three economists, Scott R. Baker, Nick Bloom, and Steven J. Davis. I mentioned their approach here when it was first being developed back 2012. They combine three sources of data: “the frequency of newspaper articles that reference economic uncertainty and the role of policy; the number of federal tax code provisions that are set to expire in coming years; and the extent of disagreement among economic forecasters about future inflation and future government spending on goods and services.” The average value from 1985-2010 is arbitrarily set at 100. Thus, you can see spikes during the Great Recession, the pandemic, and now early in 2025.

Editorial Board, Washington Post, March 4, 2025.

Excerpt:

All this could cost the typical U.S. household about $1,245 in lost purchasing power, according to a projection from the Budget Lab at Yale. Another model estimates that if Canada, China and Mexico retaliate symmetrically — imposing same-size tariffs on U.S. goods — American incomes would fall 0.5 percent in real terms. Real wages in Pennsylvania, Wisconsin, Michigan and Ohio would fall by almost 0.6 percent.

To see how this works, consider the auto industry, the most integrated in North America. Thirty-eight percent of the value of cars imported from Mexico comes from parts and components made in the United States. Seventeen to 36 percent of the makeup of Cadillac models assembled in the United States is sourced in Mexico. Auto parts cross North American borders several times before ending up put together on a dealer’s lot. A 25 percent tariff would boost their price on every crossing, decimating the industry’s competitiveness.

DRH note: Washington Post owner Jeff Bezos recently told his editorial writers that they should write editorials in favor of free markets. This editorial is implicitly in favor of free markets. Maybe the editorial writers are paying attention?

by Jeffrey Miron and Karthi Gottipati, Libertarian Land, March 5, 2025.

Excerpt:

Libertarians, however, distinguish between government-imposed mandates and those set by private entities, emphasizing the unintended and potentially harmful consequences of government mandates. For instance, one study suggests that such mandates eroded public trust in government institutions and, paradoxically, made vaccine-hesitant individuals even less willing to get vaccinated.

That said, libertarians defend the right of private entities to require vaccinations for employees, customers, or other stakeholders.

A recent study illustrates the effectiveness of this private-sector approach:

Our findings reveal that employer vaccine mandates significantly increased staff vaccination rates. This had life-saving effects on the health of nursing home residents, who experienced reductions in both COVID-19 cases and mortality. For every two facilities that implemented a mandate, approximately one life was saved. Given that a typical nursing home houses only 100 residents, this impact is substantial.

Note: The accompanying picture is a graph of economic uncertainty.