COMMENT #1: Marty: It is painfully obvious why the bankers always tried to have the government silence you. Every aspect of what you forecast eventually unfolds, turning this random walk theory into propaganda. Bloomberg has reported that French corporate rates are now below government. The shift from Public to Private is right before our eyes.

Thank you for a fantastic WEC. I loved your passion for saving the country if they listen. I also want to enroll my children in your gift to society, a WEC for the next generation. It’s just brilliant.

JD

COMMENT #2: Hi Martin,

As you predicted, corporate bonds of French companies now trade at yields below those of the government. Public to Private wave in full swing.

Best,PH

COMMENT #3: I was in Moscow on business, and you were on national TV. What does that say about America? I have seen you on French TV, but never in the USA. They want to keep us deaf, dumb, blind, and obedient. Tune in, and we will tell you when Kamala will sweep everything. MSNBC lost 40% of its viewers. Truth sells – not propaganda.

SG

REPLY: We have the largest database of anyone on the planet, covering the globe internationally and with an unlimited scope, from finance to wealth, nature, and disease. When there were the Sovereign Defaults of 1931 in Europe, Asia, and South America, combined with the corporate bankruptcies, the flight to quality was to the US treasuries. Even the City of Detroit suspended its debt. You see, the peak in the premium for corporate over treasuries was in 1932. That coincided with the low in the stock market. When FDR came into power on March 4, 1933, after winning the 1932 election, you can see that the premium in corporate rates began to decline. In Europe, corporate rates dropped below government as people began to smell a rat.

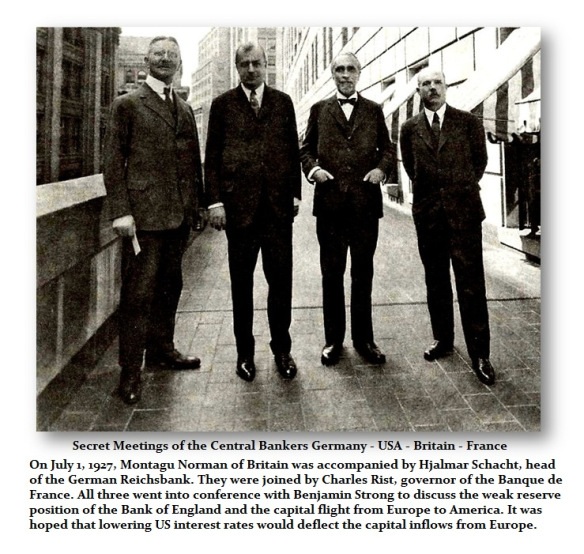

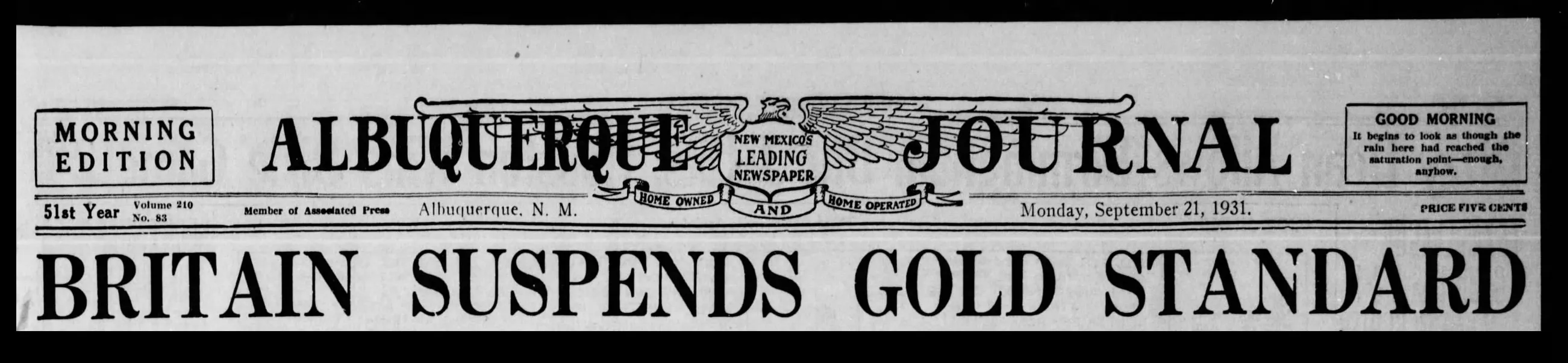

In 1927, the Fed lowered rates in the States, trying to deflect capital back to Europe. However, the smart money realized that the Fed’s action confirmed that a serious debt crisis was on the horizon in Europe. Even Britain, the Financial Capital of the World before World War I, suspended its debt, as reported on September 21st, 1931.

You can track this important relationship through Socrates. When the confidence in the government declines, the capital will always shift from Public to Private and vice versa.

The movie The Forecasted was played on national TV, even in Canada, Europe, and Scandinavia. You are correct, and they would never show it in the USA. Anything that shows the true nature of those in power will never be shown.