People continue to ask if Bitcoin will replace the dollar. They believe that the recent surge in Bitcoin indicates that it will topple the USD as the world’s reserve currency, but that is merely propaganda. You must understand that Bitcoin is simply a trading vehicle, not a currency. I cannot stress that point enough. My opinion has been unpopular, and clients have walked away due to my stance on crypto. That’s fine, as I am not in this for the money. I can only adequately inform my clients of the unbiased truth and hope that those willing to listen will heed the computer’s warnings.

To begin with, there is much speculation about the founder(s) — Satoshi Nakamoto – who created Bitcoin (BTC) on June 3, 2009. The mystery person or group (or government agency) has been MIA since 2011. Yet 1 million Bitcoins remain in their original account, untouched. His wallet is estimated to be worth over $81 billion at the time of this writing, and if this is indeed an individual, he or she is one of the top 15 richest people in the world. They have never moved a fraction of a BTC from their account. So, one wallet contains 5% of all mined bitcoin. Will this person or entity perpetually hold?

They expect us to believe some mysterious Japanese man created the blockchain technology and simply evaded all world governments. They claim Bitcoin is an anti-government vehicle, but it is a bureaucrat’s dream because it allows them to track where funds are coming from and going. In 1996, the US government released a white paper entitled, “How to make a mint: the cryptography of anonymous electronic cash.” Released by the National Security Agency Office of Information Security Research and Technology, this document explains how a government agency could create something like Bitcoin or another cryptocurrency. They had been attempting to create one for years and then magically Bitcoin came on the scene.

I encourage anyone interested in crypto to read my article regarding this study. Blockchain was created with surveillance at the top of mind.

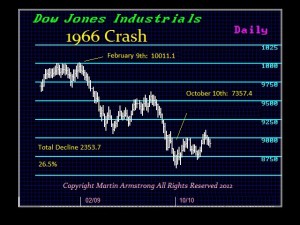

Bitcoin’s price is akin to the problem that existed when the bubble burst in 1966 with mutual funds because they were listed back then. The value can change at a volatility rate of 10x that of the dollar, making it a highly dangerous instrument as a store of wealth. It is solely a trading vehicle until they weigh it and the value is changed.

In 1966, investors bid the mutual funds up beyond net asset value, so during the crash, people lost everything when they thought it was a secure investment. The net underlying assets may have dropped 20%, but they paid 20% over the net asset value and then sold at 50% of the net asset value. Many mutual funds crashed 70-90%, whereas the Dow drop was 26.5%. Ever since mutual funds have no longer been allowed to be listed. You go in and out at net asset value. Bitcoin must change its structure, or it will never become a valid currency with a stable store of value, which is supposed to be the whole point. It is just an asset class of high volatility.

I have not been bullish on digital currency, as it’s a trading vehicle no different than any other commodity or stock. Sure, a profit could be made, and many have had great success. We do include Bitcoin in our models, and those subscribed to Socrates will see that our arrays are picking up on Bitcoin next year.

Bitcoin is a trading vehicle that is no different from wheat or cattle. It is NOT a store of wealth, as it fluctuates like everything else. It rises and falls no different than any other trading instrument. It is not a “store” of value maintaining some constant value to park your money. We need to get realistic here. The concept of Bitcoin replacing the dollar fails to comprehend what makes something the world’s reserve currency. I will write a piece explaining that aspect since it is crucial to understand.