With Republicans appearing to have secured a sweep of the White House and both chambers of Congress, the most immediate question for many financial advisors and their clients is what impact the election results will have on the scheduled expiration of the Tax Cuts & Jobs Act (TCJA) at the end of 2025.

At a high level, the Republican trifecta would appear to set the stage for much of TCJA to be extended beyond the original 2025 sunset date. However, with the makeup and priorities of the incoming Congress differing from those in 2017 – and with President-elect Trump having made numerous promises for new tax cuts on the 2024 campaign trail – there will inevitably be portions of the existing law that Congress will aim to amend or even expand beyond the original tax cuts created by TCJA. Which means that the question going forward is not so much whether TCJA will be extended, but rather which portions will remain in their current form and which may have some ‘wiggle room’ for change in the next tax bill.

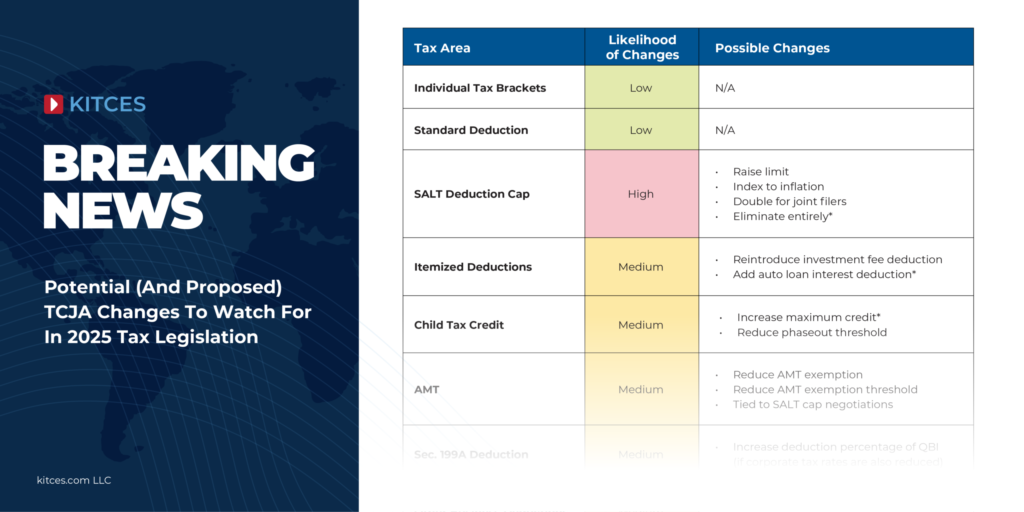

For example, the current 7 tax brackets and increased standard deduction that have been in effect since 2018 are expected to remain largely unchanged. However, the $10,000 limit on State And Local Tax (SALT) deductions, which has been highly contentious with both Democrat and Republican supporters and detractors, is much more likely to become a negotiating point. Some legislators advocate keeping the SALT cap as is, others push for it to be raised in some form, and still others (including the president-elect) want the SALT cap to be eliminated entirely.

Other key areas likely to be impacted include:

The Child Tax Credit, which is currently capped at $2,000 per child, with some bipartisan support to raise it at least to the pandemic-era $3,600 maximum;

The Alternative Minimum Tax (AMT), which currently affects very few taxpayers, could be amended as part of SALT cap negotiations to kick in at lower income levels for households with high SALT deductions, offsetting the impact of raising or eliminating the SALT deduction cap;

The Section 199A deduction for Qualified Business Income (QBI) for pass-through owners, which could conceivably be increased if Congress pursues Trump’s proposal to cut corporate tax rates from 21% to 15% in order to preserve the proportionate difference between pass-through and corporate tax rates;

The gift and estate tax exemption, which appears likely to remain at its current elevated level, reducing the urgency for high-net-worth households to gift assets or implement trust strategies to reduce their taxable estate before 2026 (and, in some cases, making it better to avoid gifting assets to preserve the step-up in basis those assets would receive otherwise).

Furthermore, the Trump campaign has proposed a number of additional tax cuts, including tax-free treatment of income from tips, overtime pay, and Social Security benefits, and even eliminating income tax entirely in favor of tariffs. Notably, though, any of these proposals would still need approval from a Congress that may prefer to extend existing tax cuts rather than introduce new ones.

What’s certain heading into 2025, however, is that there will be a new tax bill to extend and/or replace TCJA. And while it may not represent as large of a shift from the status quo as TCJA did in 2017, it could still have tax planning implications for millions of Americans – at least until it reaches its own sunset date in another 8–10 years!

Read More…