Since the Tax Cuts & Jobs Act (TJCA) was passed in 2017, few households have been subject to the Alternative Minimum Tax (AMT), which TCJA restructured so that it applied mainly to a select number of upper-income households. But with the anticipated sunset of TCJA in 2026 and the reversion to the pre-2018 AMT rules, a large subset of households will find themselves owing AMT – many of whom will do so for the first time.

At a high level, the AMT calculation works by adding a number of ‘adjustment items’ to a taxpayer’s taxable income, most commonly including the standard deductions, the deduction for state and local taxes, interest from tax-exempt ‘private activity’ bonds, and unrealized gains on the exercise of Incentive Stock Options (ISOs). Once these adjustment items have been added to the taxpayer’s regular income sources to calculate their ‘AMT income’, a single large AMT exemption is subtracted from that amount to arrive at the tax base off of which AMT is calculated. The tax itself is calculated using 2 brackets of 26% and 28%, and the taxpayer owes AMT if their tax as calculated using the AMT method is higher than it is when using the ‘regular’ tax calculation.

The sunset of TCJA will add back several common adjustment items that will create potential AMT exposure for many households. For example, personal exemptions and miscellaneous itemized deductions such as investment advisory fees, both of which will be reinstated after TCJA’s sunset. Additionally, the elimination of the $10,000 limit on state and local tax deductions will make that adjustment much higher for property owners and households in high-tax states.

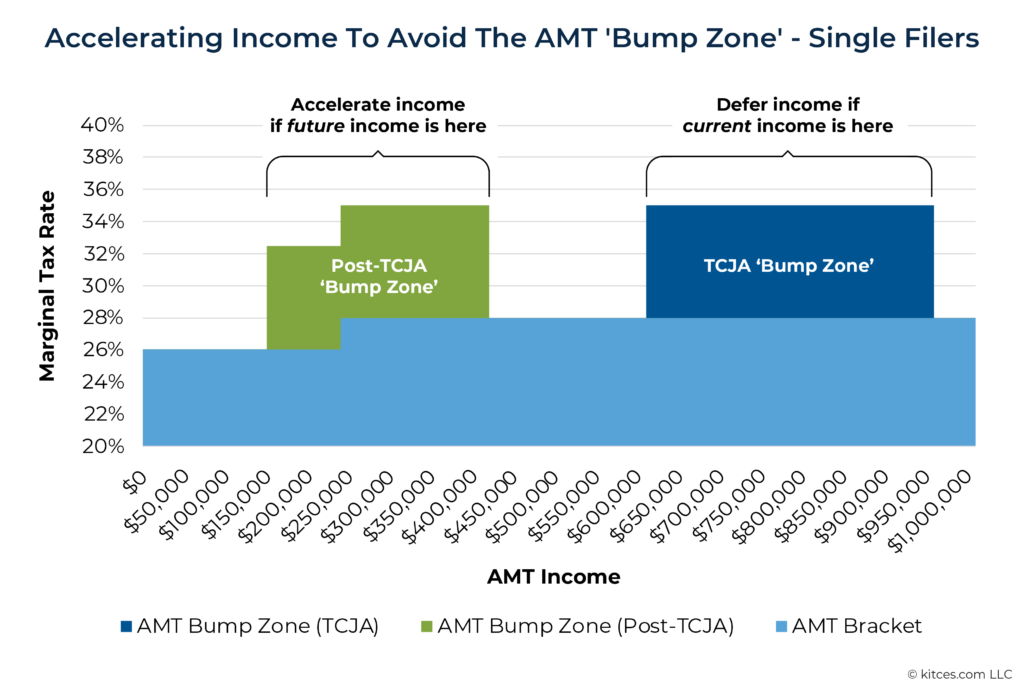

Furthermore, TCJA’s sunset is set to reduce the amount of the AMT exemption, as well as to drastically lower the income threshold at which the exemption begins to phase out. Which means AMT will be triggered more frequently in households with ‘only’ $100,000–$600,000 of income. Households subject to AMT may also face a ‘bump zone’ in the phaseout range of the AMT exemption where any additional income is effectively taxed at a marginal rate of 32.5% and 35%.

For financial advisors, understanding the upcoming rule changes around AMT can help with identifying which clients might be subject to AMT starting in 2026. Which, from a practical perspective, can help with understanding whether the client needs to boost tax withholding or estimated payments in anticipation of the AMT tax owed – but can also help with recognizing planning opportunities to either avoid AMT exposure or reduce its impact. For example, clients with unexercised ISOs could exercise those options prior to TCJA’s sunset without AMT exposure. However, if they were to wait until 2026, they would owe AMT (and need to find or borrow funds to pay the AMT triggered by the exercise). Although for clients currently in the AMT ‘bump zone’, it may actually be better to delay recognizing the income instead!

The key point is that, while it won’t always be possible to avoid AMT (since AMT itself is intended to prevent higher-income households from avoiding taxes via high deductions and tax-exempt income sources), planning for AMT’s changes post-TCJA sunset can help to minimize the impact of AMT and at least avoid any ‘surprise’ tax bills for those who don’t see it coming. And because TCJA’s sunset is expected to overwhelmingly increase households’ exposure to AMT, there’s not much downside in being proactive to avoid or minimize future AMT – since the downside if TCJA is ultimately extended is that there would be little or no AMT exposure anyway!

Read More…