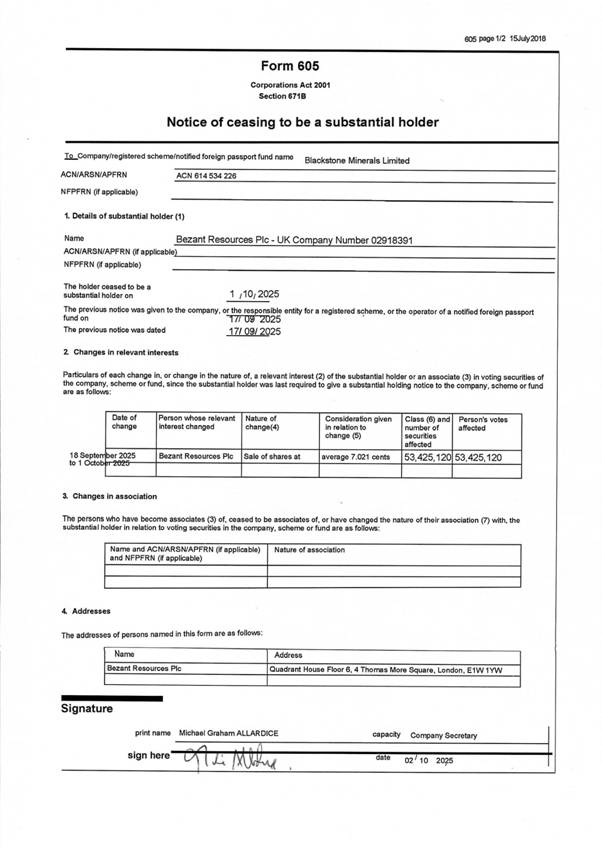

Bezant (AIM: BZT), the copper-gold exploration and development company, has today filed a Form 605 – Notice of ceasing to be a substantial holder with ASX listed Blackstone Minerals Ltd (“Blackstone“). Bezant’s shareholding of Blackstone shares is now 80,574,880 Blackstone shares. Since the Company’s announcement on 17 September the Company has in the period 18 September to 1 October 2025 sold 53,425,120 Blackstone shares at an average price of AUD 7.021 cents ( approximately 3.45 pence) per share for gross proceeds of AUD 3.75M (approximately £1.84M).

Attached is a copy of the Form 605.

For further information, please contact:

|

Bezant Resources Plc Colin Bird Executive Chairman |

|

|

|

Beaumont Cornish (Nominated Adviser) |

|

|

|

Novum Securities Limited (Joint Broker) Jon Belliss |

+44 (0) 20 7399 9400 |

|

|

Shard Capital Partners LLP (Joint Broker) Damon Heath |

+44 (0) 20 7186 9952 |

or visit http://www.bezantresources.com

Beaumont Cornish Limited (“Beaumont Cornish”) is the Company’s Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish’s responsibilities as the Company’s Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.

Source

Read the full article here