Blue Jay Gold is an emerging Canadian explorer leveraging the brownfield advantage of proven mineralization and established infrastructure, while applying modern exploration techniques to drive growth and enhance shareholder value.

Blue Jay’s mantra is simple: “Be where the gold is.” By focusing on brownfield projects with historic production, existing infrastructure, and proven mineralization, the company reduces risk and cost while increasing discovery potential. With year-round exploration—Yukon in summer and Ontario in winter—Blue Jay delivers continuous news flow and diversified value creation.

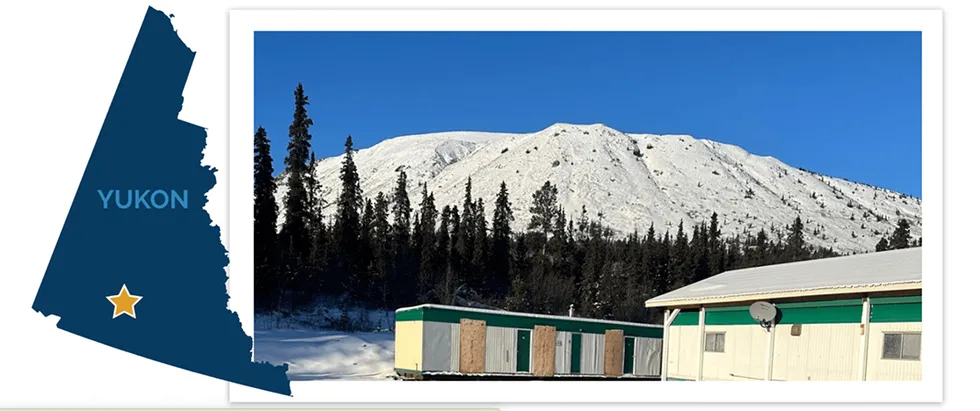

Blue Jay’s flagship Skukum Gold Project, 55 km south of Whitehorse, Yukon, spans 170 km² and hosts an extensive network of gold- and silver-rich vein systems across four main zones: Skukum Creek, Goddell, Mt. Skukum, and Charleston. A 2022 NI 43-101 resource estimate outlined 1.59 Mt grading 8.16 g/t AuEq for 0.42 Moz indicated, and 3.02 Mt grading 5.33 g/t AuEq for 0.52 Moz inferred. Skukum Creek accounts for the majority, with 0.26 Moz AuEq indicated at 7.8 g/t and 0.31 Moz inferred at 5.7 g/t, underscoring both scale and high-grade potential.

Company Highlights

- High-grade Resource Base: Skukum gold project in the Yukon hosts 0.42 Moz indicated at 8.2 g/t AuEq and 0.52 Moz inferred at 5.3 g/t AuEq, anchored by multiple high-grade gold and silver structurally controlled mineralized systems.

- Brownfield Advantage: Historic production (~80,000 oz gold at 12 g/t from Mt. Skukum, 1986–1988) with a 50-person camp, road access and ~6 km drive development already in place.

- District-scale Potential: 170 sq km land package traversed by more than 50 km of mineralized structures, including three primary corridors (Skukum Creek, Charleston, Goddell) and several secondary zones.

- Ontario Growth Pipeline: The Pichette project in the Beardmore-Geraldton Greenstone Belt provides winter drilling opportunities adjacent to Equinox’s Greenstone Mine.

- Strategic Growth Plan: Aim to test the immediate extensions to known mineralization and drill-test new target zones over the 18-24 months.

- Experienced Leadership: Management team and board combine diverse experience in global exploration and asset maturation, and capital markets expertise, with proven track records in discovery and financing.

This Blue Jay Gold profile is part of a paid investor education campaign.*

Click here to connect with Blue Jay Gold to receive an Investor Presentation

Read the full article here