Brixton Metals (TSXV:BBB,OTCQB:BBBXF,FRA:8BX1) is a Canadian mineral exploration company focused on the discovery and development of copper, gold, silver, and critical minerals across North America. Its flagship Thorn Project in British Columbia is a large, district-scale property hosting multiple high-priority porphyry and epithermal targets.

Beyond Thorn, Brixton Metals is advancing non-core assets through strategic partnerships and option agreements with industry leaders including Ivanhoe Electric (NYSE American:IE;TSX:IE) and Eldorado Gold (TSX:ELD,NYSE:EGO). These partner-funded programs preserve capital while retaining upside exposure, strengthening the balance sheet and allowing Brixton to focus on high-impact exploration opportunities with reduced risk.

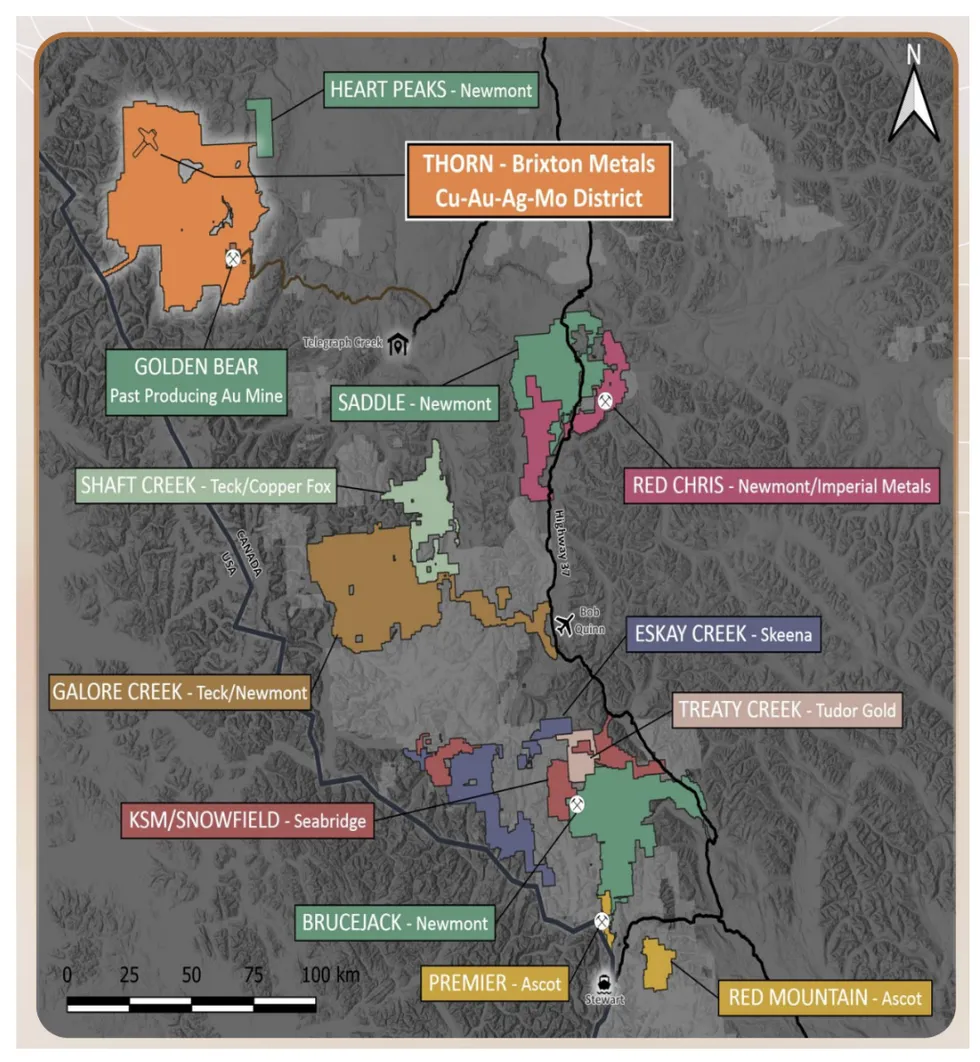

The Thorn Project is Brixton Metals’ flagship asset, spanning approximately 2,945 square kilometres in northwestern British Columbia along the same mineralized trend as the province’s famed Golden Triangle, one of the world’s most prolific regions for porphyry and epithermal deposits. The district-scale property hosts widespread porphyry-style alteration with copper, gold, silver, and molybdenum mineralization, offering substantial exploration upside. The project is readily accessible via a 45-minute flight from Whitehorse, Yukon.

Company Highlights

- Flagship Project: Thorn Project in BC, Canada – a fully owned, district scale copper-gold porphyry project on a 2,945 sq km claim block, on trend with BC’s prolific Golden Triangle.

- Pipeline Projects: Includes Langis Project (Ontario, Canada), Hog Heaven (Montana, USA), Atlin Goldfields (BC, Canada), providing diversified exposure to copper, gold and silver

- Partnerships: Strategic option agreements with tier-one companies such as Ivanhoe Electric and Eldorado Gold provide technical validation and fund exploration on non-core projects.

- Shareholder Base: Strategic investors include, but are not limited to BHP (approx. 14.8 percent) and Crescat Capital

- Management Expertise: Led by co-founder Gary Thompson, the management team has an average tenure of nearly 15 years, showing significant stability.

- 2026 Outlook: With a recently closed $12.2 million financing, the company is fully funded for a 2026 program that includes a winter drill campaign at the Langis Silver Project (Ontario) to capitalize on record-high silver prices.

This Brixton Metals profile is part of a paid investor education campaign.*

Click here to connect with Brixton Metals (TSXV:BBB) to receive an Investor Presentation

Read the full article here