Corcel Exploration (CSE:CRCL,OTCQB:CRLEF) is a Vancouver-based explorer unlocking copper and gold opportunities across North America. Anchored by its flagship Yuma King project in Arizona, the company applies historical datasets, cutting-edge geoscience, and modern technology to uncover and expand near-surface and buried mineralized systems.

Corcel’s approach is centered on disciplined, data-driven exploration. The company’s 2025 work program includes its maiden 2,000-meter diamond drill program, along with IP surveys and hyperspectral mapping to test priority copper-gold skarn and porphyry targets across the Yuma King Mine, Yuma King West, and Three Musketeers zones. By validating and extending historical mineralization, Corcel aims to delineate a near-term resource base while unlocking the broader district-scale potential.

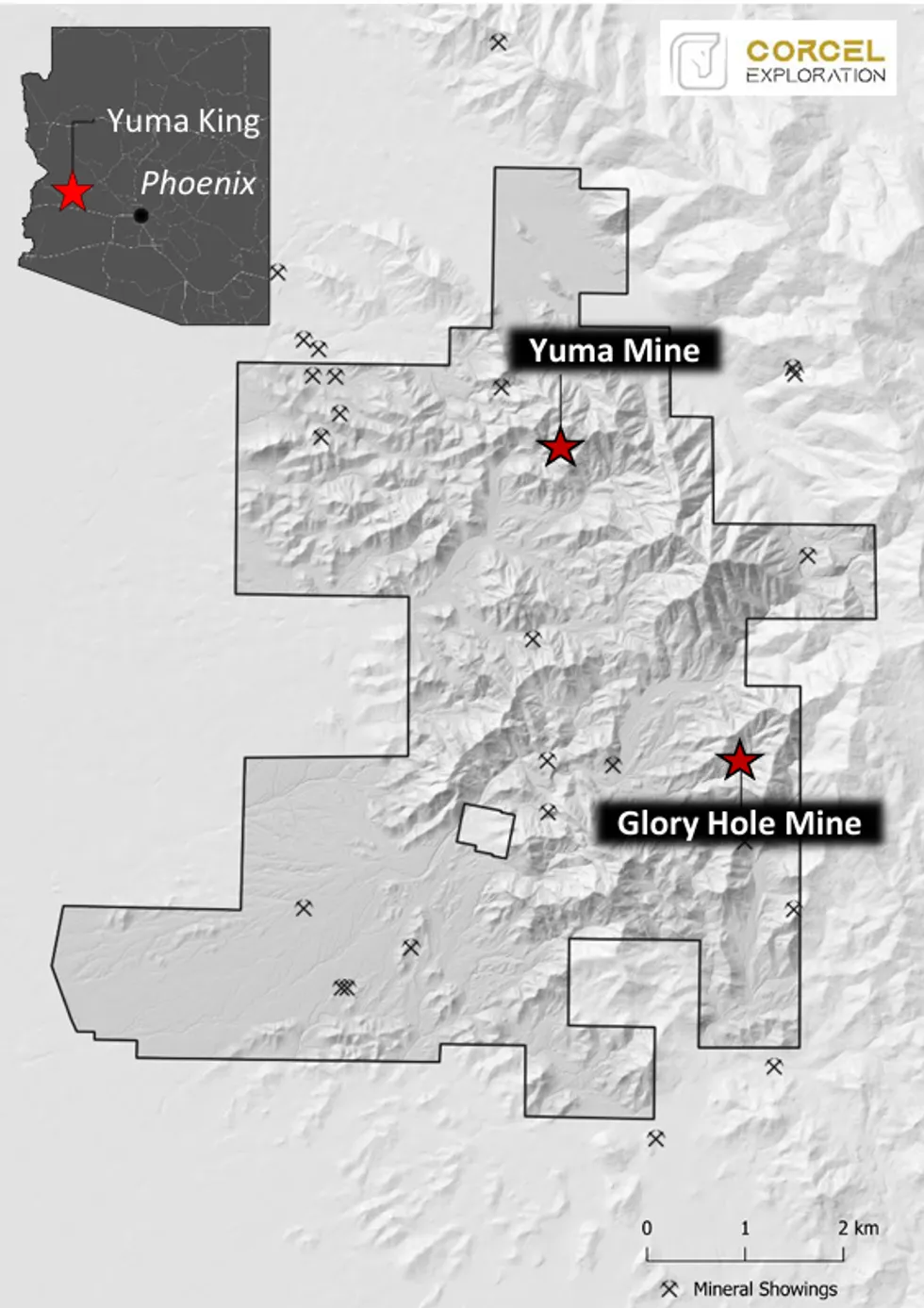

The Yuma King copper-gold project covers a 3,200-hectare district-scale property in the historic Ellsworth mining district of west-central Arizona, approximately 150 km northwest of Phoenix. The property hosts the past-producing Yuma mine, where operations between 1940 and 1963 yielded high-grade copper and gold ore.

Company Highlights

- Flagship Yuma King Project (Arizona): District-scale, 3,200-hectare land package with 515 federal mining claims in the historic Ellsworth mining district.

- High-grade Historical Production: 8,600 tons averaging 2.3 percent copper, 0.3 oz silver per ton, and 0.03 oz gold per ton from the past-producing Yuma mine.

- Dual Mineralization System: Copper-gold skarn mineralization with potential for a buried copper-molybdenum-gold porphyry system.

- Strong Recent Results: Rock samples grading up to 17.15 grams per ton gold and 11.6 percent copper, confirming widespread surface mineralization.

- Advanced Drill-ready Targets: 1.6 km skarn corridor open along strike and down-dip; multiple untested anomalies from geophysics and soil sampling.

- Experienced Leadership: Led by a technically strong management team with deep experience in discovery, development, and capital markets.

- Strategic US Positioning: Located near infrastructure and in the same state as one of only three US copper smelters.

This Corcel Exploration profile is part of a paid investor education campaign.*

Click here to connect with Corcel Exploration (CSE:CRCL) to receive an Investor Presentation

Read the full article here