LAURION Mineral Exploration (TSXV:LME,OTCPINK:LMEFF, FSE:5YD) is a Canadian mid-stage exploration and development company advancing its 100-percent-owned Ishkōday project in Ontario’s Greenstone Belt. The 57 sq km project hosts gold and zinc-copper-silver mineralization, plus two past-producing mines and roughly 280,000 tonnes of historical stockpiles averaging 1.14 g/t gold—offering multiple value streams and strong leverage to both precious and base metals.

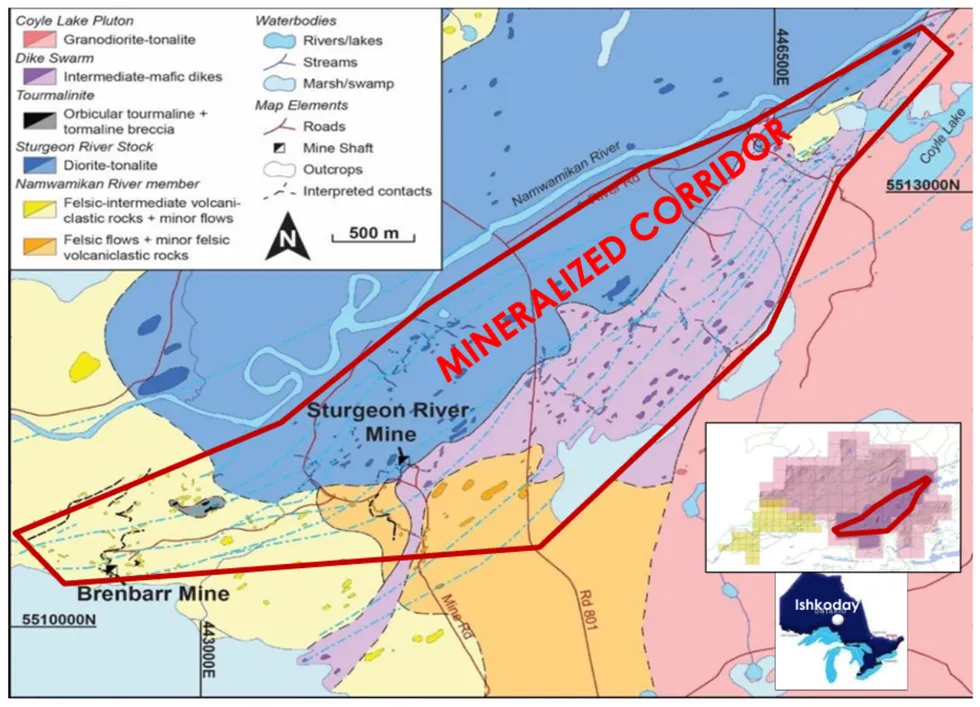

Ongoing drilling, surface work and 3D modeling, supported by leading technical and permitting partners, are outlining a large mineralized system across a 6 km by 2.5 km corridor, highlighting Ishkōday’s district-scale potential. LAURION is also advancing its AEP to enable underground access and potential processing of historical stockpiles, which contain an estimated 10,000 ounces of near-term gold and could provide early cash flow to support future exploration.

LAURION’s approximately 73.6 percent insider ownership reflects strong alignment and long-term confidence in the company’s strategy.

Company Highlights

- Dual-mineralization, district-scale opportunity: The Ishkōday project features an uncommon pairing of two mineral systems in a single district: 1) a gold dominant orogenic system and gold with silver-zinc-copper epithermal system.

- Brownfield advantage: Anchored by two historic past-producing mines within a 57 sq km land package in Ontario’s prolific Greenstone Belt.

- Exceptional insider alignment: Approximately 73.6 percent insider, friends-and-family ownership demonstrates long-term confidence in the project.

- Robust technical foundation: Nearly 100,000 metres of drilling, advanced 3D geological modeling, and partnerships with leading engineering, geoscience and ESG firms.

- Near-term cash-flow potential: Surface stockpile and tailings with an historic estimation, containing roughly 10,000 ounces (280kt @ 1.14 g/t Au) of gold pending advanced exploration permit approval.

- Strategic rerating and M&A appeal: Ongoing derisking, resource growth and permitting progress position Ishkōday as a future development or acquisition candidate in a Tier-1 jurisdiction.

This LAURION Minerals Exploration profile is part of a paid investor education campaign.*

Click here to connect with LAURION Minerals Exploration (TSXV:LME) to receive an Investor Presentation

Read the full article here