A convergence of industry investments, government initiatives and a shifting global trade dynamic is creating an environment ripe for the development of a North American battery supply chain, with lithium playing a leading role. These trends are reshaping the region’s industrial base and opening the door for early movers to capture long-term value.

Here are five forces fueling this transformation, and how companies up the value chain are leveraging this compelling opportunity.

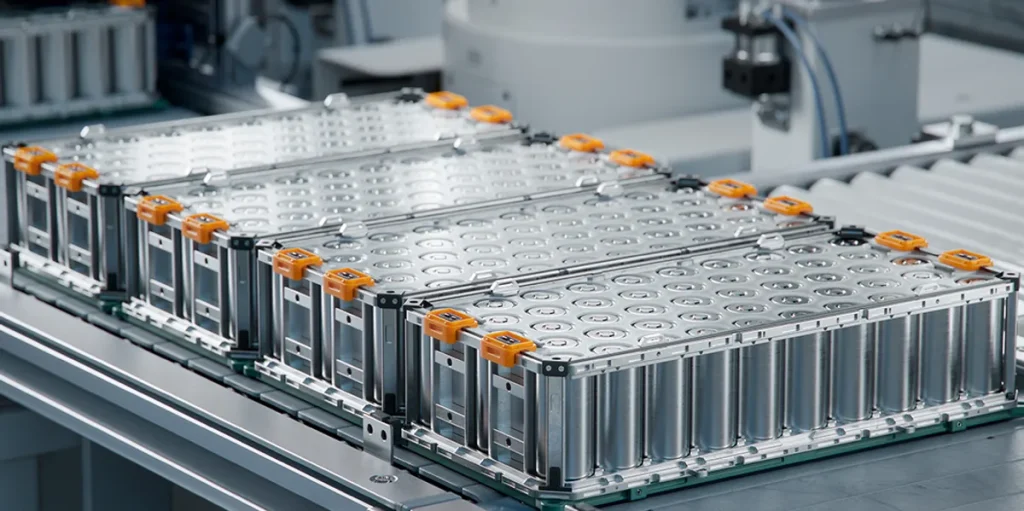

1. Surging EV and energy storage demand

The surging lithium demand is driven by both rising electric vehicle (EV) adoption and grid-scale storage requirements. The US Department of Energy forecasts domestic lithium battery demand to grow five to 10 times by 2030.

Globally, the International Energy Agency expects exponential increases in lithium demand from 92,000 tons in 2023 to 442,000 tons by 2030 and to 1.20 million tons by 2040, just from cleantech demand alone. This growth creates a significant runway for upstream and midstream players to lock in long-term contracts and market share.

2. National security and geopolitical strategy

China controls more than half of the world’s lithium refining capacity, creating strategic vulnerabilities for Western economies. The US government is moving decisively to reduce dependency, by proposing nearly $1 billion in new funding for critical minerals development and allocating over $3 billion in grants to domestic EV battery projects.

Canada is following a similar path, committing up to C$52.5 billion in support for EV and battery manufacturing investments since 2022. Ontario, in particular, has become the epicenter of Canada’s EV and battery boom. The province has attracted C$45 billion in new investments from global automakers and battery manufacturers, signalling an anticipated surge in demand for lithium to supply these production facilities.

Emerging Ontario lithium projects that aim to supply this growing regional demand are positioned to benefit from strong political tailwinds and downstream customer pull.

3. Automakers securing supply at the source

Major automotive OEMs are no longer content to rely solely on market purchases, but are now investing at the mine gate. General Motors’ (NYSE:GM) $625 million spend for a 38 percent stake in Lithium Americas’ (TSX:LAC,NYSE:LAC) Thacker Pass mine in Nevada ensures decades of supply for the automotive company.

Ford Motor (NASDAQ:F) and Stellantis (NYSE:STLA) have also signed long-term offtake deals with North American lithium producers. This vertical integration trend is set to de-risk future input costs for automakers while providing mining companies with capital stability and assured revenue streams.

In Ontario, Green Technology Metals (ASX:GT1) is already aligning with this trend. The company has secured an offtake agreement with LG Energy Solution, one of the world’s largest battery manufacturers, covering 25 percent of initial production from the Seymour project. This early partnership is a strong signal that global downstream players are looking to Ontario as a reliable, long-term source of lithium.

4. Demand outpacing local supply capacity

By 2030, regional lithium demand is projected to grow fivefold, yet current domestic production can only meet a fraction of that need. The Thacker Pass project in Nevada alone could supply enough lithium carbonate in its first phase to help produce 800,000 EVs annually.

Even with the projected lithium production surge, the supply gap remains stark, creating a multi-year runway for new entrants. As an emerging Ontario player, GT1 is directly positioned to help close this gap. With a combined 30.4 Mt resource base across its Seymour and Root projects, GT1 is advancing a staged development plan to deliver both spodumene concentrate and battery-grade lithium hydroxide through its planned Thunder Bay conversion facility.

Ontario’s EV and battery ecosystem creates a local demand center that GT1 is uniquely placed to serve. Unlike many early-stage peers, GT1 already has offtake security and government funding support, making it one of the most advanced projects ready to meet the supply shortfall.

5. Infrastructure and industrial ecosystems falling into place

North America’s battery ecosystem is rapidly materializing. Ontario and other regions are becoming EV and battery manufacturing hubs, with tens of billions in automaker commitments driving demand for local lithium. These facilities are being supported by robust infrastructure, including rail, highways, ports and abundant low-cost hydropower, which effectively lower costs and accelerate project development. At the same time, established mining service networks and skilled labor pools in resource-rich provinces are being reactivated, reducing execution risk for new entrants.

GT1 is plugging in directly into this industrial ecosystem, benefitting from immediate access to clean power, transport corridors and nearby battery manufacturing capacity. This integration strengthens GT1’s investment case as a key link between upstream lithium resources and downstream EV production.

Investment spotlight: Green Technology Metals

For Ontario-focused investors, Green Technology Metals offers a unique entry point into North America’s rapidly expanding lithium supply chain. With more than 30 Mt of defined lithium resources across its Seymour and Root projects, GT1 is advancing a staged strategy that integrates mining, concentration and downstream conversion into battery-grade lithium hydroxide. The company has already secured an offtake with LG Energy Solution for 25 percent of Seymour’s initial production. It has also partnered with EcoPro Innovation to pilot and develop a Thunder Bay conversion facility, demonstrating clear alignment with global Tier-1 battery players.

Ontario’s strong industrial base, low-cost hydropower and more than C$45 billion in automaker EV commitments provide a ready-made demand center for GT1’s production. Backed by strategic investors, access to Canadian government funding and a leadership team with a proven track record in lithium project development, GT1’s value proposition goes beyond the junior exploration space and excels as a vertically integrated business, offering a compelling opportunity for investors seeking leveraged exposure to the structural supply gap in North American lithium.

Investor takeaway

North America’s lithium sector is quickly transforming, driven by government incentives, automaker investments and a race to build domestic supply chains. A persistent supply deficit, however, continues to outpace production well into the next decade. For investors, this imbalance creates rare, early-stage opportunities in companies positioned at the heart of this transition. GT1 stands out for its integrated mine-to-chemical strategy, Tier-1 jurisdiction and strategic partnerships with global battery leaders, offering leveraged exposure to one of the most critical supply chain buildouts in North America.

This INNSpired article is sponsored by Green Technology Metals (ASX:GT1). This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by Green Technology Metals in order to help investors learn more about the company. Green Technology Metals is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Green Technology Metals and seek advice from a qualified investment advisor.

Read the full article here