Lithium. Uranium. Vanadium. Titanium. Iron.

These are the essential building blocks of the clean energy era — powering electric vehicles, renewable energy storage, defense technologies and advanced manufacturing. They’re also at the heart of a new industrial race that’s reshaping investment, policy and geopolitics across North America.

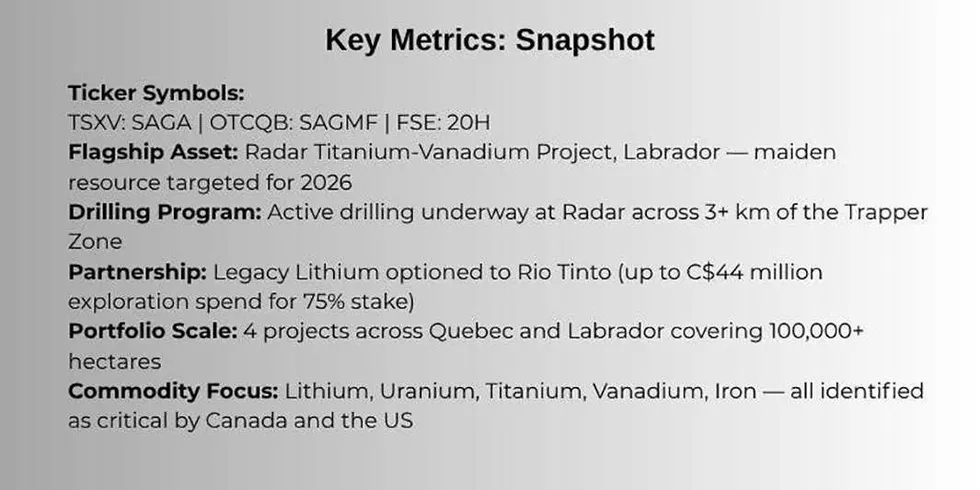

Across Canada’s vast northern provinces, exploration teams are already on the ground turning policy into progress. Among them is Saga Metals (TSXV:SAGA,OTCQB:SAGMF,FWB:20H), a Canadian exploration company advancing a diversified portfolio of projects across Canada. Saga holds 100 percent ownership in properties rich in the very minerals the world is scrambling to secure. Positioned in safe jurisdictions, aligned with national strategies and supported by infrastructure advantages, Saga is helping shape the foundation of North America’s resource independence.

A new strategic landscape for North America

Critical minerals have moved from the margins of industrial policy to the center of global strategy. The US government’s unprecedented decision to take a 5 percent equity stake in Lithium Americas (TSX:LAC,NYSE:LAC) marked a turning point. Washington is no longer just regulating the energy transition — it’s investing in it.

Canada has also acted decisively in pushing towards clean energy.

Ottawa’s Critical Minerals Strategy, backed by nearly C$4 billion in federal funding, aims to make the country a “global supplier of choice” for responsibly sourced critical minerals.

These actions signal a decisive shift: minerals are no longer just commodities, they are strategic national assets. For investors, this means that projects in stable jurisdictions like Canada are not only geologically attractive, but also politically supported.

Supercycle of critical minerals demand

Demand for critical minerals is surging on a scale not seen since the post-war industrial boom.

The lithium market is projected to expand nearly eightfold, and demand is expected to triple from today’s levels by 2040. Copper faces a 30 percent shortfall by 2035 if new projects are not developed.

Uranium is regaining momentum as nuclear energy re-emerges as a low-carbon solution. Vanadium and titanium are finding new applications in aerospace, defense and large-scale energy storage.

At the same time, supply remains heavily concentrated. China controls nearly two-thirds of global lithium refining, over 90 percent of rare earths, 42 percent of global vanadium production and one-third of the world’s titanium supply, while controlling two-thirds of refinement. This imbalance has fueled an urgent push in North America and Europe to diversify supply chains. For explorers in Canada, this environment represents an unparalleled opportunity.

Building the supply chain foundation for critical minerals

North America is not leaving this transition to chance — it is funding it aggressively.

Canada: The Critical Minerals Infrastructure Fund provides C$1.5 billion funding through 2030, while the Strategic Innovation Fund has committed another C$1.5 billion for advanced projects. In total, nearly C$4 billion has been earmarked to build Canada’s domestic critical minerals supply chains.

US: In August 2025, the Department of Energy announced nearly US$1 billion in funding opportunities for mining, refining and manufacturing technologies across the critical minerals supply chain.

For investors, these programs mean projects aligned with national priorities are likely to benefit from infrastructure development, financing support and reduced policy risk.

Saga Metals: Four pillars of growth

Saga’s diversified critical minerals portfolio spans four cornerstone projects in Québec and Labrador:

Radar titanium-vanadium project (Labrador): Over 24,000 hectares hosting titanomagnetite-rich mineralization spanning an inferred 20 kilometer strike length with strong grades. Supported by road access, hydro power, a deep-water port and community partnerships. Drilling is underway, with a maiden indicated resource targeted for 2026.

Legacy lithium project (James Bay, Québec): A 65,000 hectare property in one of North America’s most active lithium districts. Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) has optioned 34,000 hectares, and can earn up to a 75 percent stake by funding C$44 million in exploration.

Double Mer uranium project (Labrador): Positioned along an 18 kilometer uranium-rich trend in proximity to Eastern Canada’s most significant uranium deposits, providing exposure to nuclear’s resurgence.

North Wind iron ore project (Labrador): Historical data indicate magnetite-rich, high-grade formations, positioning the project as a future source of high-purity iron ore for green steelmaking.

These assets give Saga broad exposure to multiple critical minerals — not a single-commodity bet, but a basket of resources essential to the global energy transition.

Early results point to globally significant titanium-vanadium opportunity

The company’s 100 percent owned Radar project has revealed one of the largest vanadiferous titanomagnetite (VTM) anomalies ever identified in North America. VTM hosts titanium, vanadium and iron ore, and early indications point to a simple mineralogy associated with Radar’s mineralization, setting the stage for a potential high rate of recovery.

Saga is currently actively drilling to release an indicated mineral resource estimate in 2026 over 3 kilometers of the inferred 20 kilometer oxide layering strike.

With a large oxide layering thickness, a near-monomineralic VTM composition and extensive mineral tenures, Radar shows the potential to become a globally meaningful VTM project potentially rivalling current leaders such as China’s Panzhihua deposit.

These emerging technical results suggest the project bears geological similarities to Panzhihua, the world’s leading VTM operation, which contributes over 40 percent of global vanadium (V2O5) production hosting a resource of 1.33 billion metric tons.

Partners in resource independence

Canada and the US are not just funding their own industries — they are coordinating policy, forging bilateral alliances and accelerating permitting. Canada has tightened rules on foreign takeovers, while the US is deploying billions to secure domestic processing capacity.

For Saga, operating entirely within Canada means direct alignment with this North American strategy. The company’s projects are eligible for exploration tax credits, potential government co-investment and strategic partnerships that enhance development potential.

As the clean energy transition accelerates, the world needs secure supplies of critical minerals more urgently than ever. Governments are investing billions, industries are racing to secure contracts and supply shortfalls are already evident.

Saga is positioned at the nexus of these trends — with diversified projects, major company partnerships and operations in one of the world’s safest mining jurisdictions. For investors, Saga represents exposure not just to mineral exploration, but to a continental movement toward energy security and industrial resilience.

Investor takeaway

The global economy is entering a resource renaissance. Governments are reshaping policy, industries are racing to adapt and supply chains are being rebuilt from the ground up. At the center of this transformation are companies like Saga, advancing projects that align geology, infrastructure and strategy with the demands of a new era.

With projects spanning lithium, uranium, titanium, vanadium and iron — and operations firmly rooted in Canada’s critical minerals future — Saga is helping to define the path forward.

This INNSpired article is sponsored by Saga Metals (TSXV:SAGA,OTCQB:SAGMF,FWB:20H). This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by Saga Metals in order to help investors learn more about the company. Saga Metals is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Saga Metals and seek advice from a qualified investment advisor.

Read the full article here