Spartan Metals (TSXV:W) is a US-focused explorer advancing its high-grade tungsten and rubidium Eagle Project in Nevada. The company is unlocking critical minerals essential to US defense, technology, and energy independence, supporting onshoring goals under the Defense Production Act.

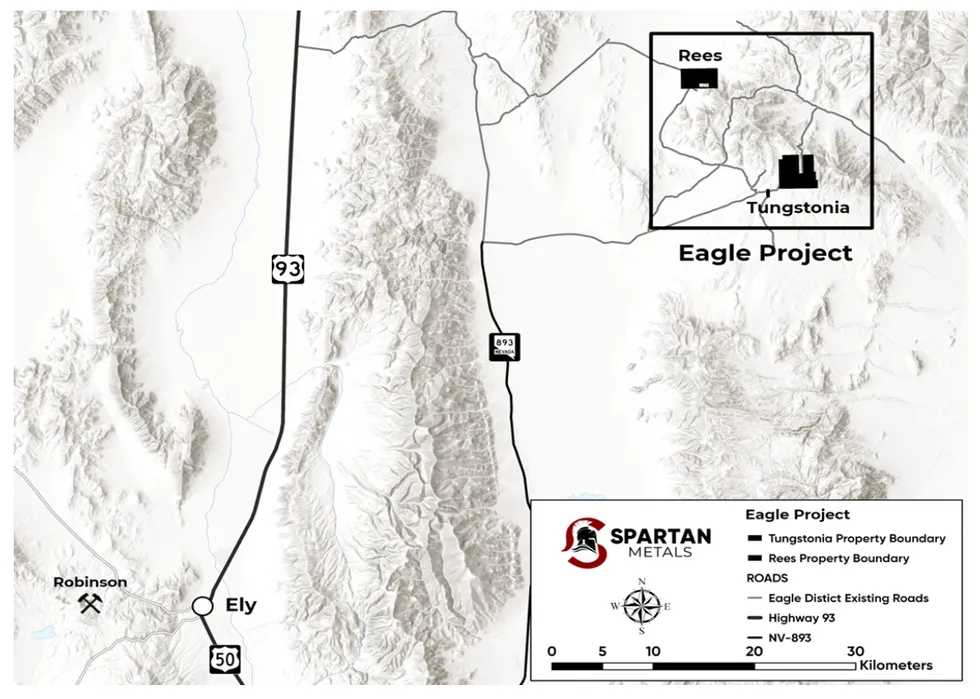

The Eagle tungsten-silver-rubidium project in eastern Nevada spans 4,936 acres across three historic mine areas — Tungstonia, Rees, and Antelope. With historic production of 8,379 units of WO₃ grading 0.6–0.9 percent, Eagle ranks among the highest-grade past-producing tungsten systems in the US, enriched with rubidium and other defense-critical metals including antimony, bismuth, indium, and arsenic. Spartan is advancing an exploration program to validate and expand this potential using modern geochemistry, geophysics, and tailings drilling.

With multiple mineralized zones, district-scale potential and strong alignment with US strategic metal initiatives, the Eagle project is the cornerstone of Spartan’s growth strategy.

Company Highlights

- Flagship Eagle Project: One of the highest-grade, past-producing tungsten mines in the US.

- Multi-metal Exposure: Targets tungsten, rubidium, antimony, bismuth, and silver – all listed as US critical minerals.

- Tier-1 Mining Jurisdiction: Located in eastern Nevada, a world-class mining state with established infrastructure and regulatory clarity.

- Strong Management and Technical Team: Led by a CEO and VP of exploration with proven discovery track

- Alignment with US Critical Minerals Strategy: Positioned to benefit from Department of Defense and US government initiatives supporting domestic critical mineral supply chains.

- Attractive Capital Structure: Tight share strucuture with management and board holding ~42 percent of shares outstanding, ensuring strong alignment with investors.

This Spartan Metals profile is part of a paid investor education campaign.*

Click here to connect with Spartan Metals (TSXV:W) to receive an Investor Presentation

Read the full article here