Cobre Limited (ASX: CBE, Cobre or Company) is pleased to announce that the Company has executed a subscription agreement with Tribeca Investment Partners Pty Ltd (Tribeca) for the placement of 40 million new fully paid ordinary shares (New Shares) at an issue price of $0.10 per New Share to raise gross proceeds of A$4 million1 (Placement).

HIGHLIGHTS

- Tribeca to invest $4.0m at $0.10/share;

- 1 for 1 option exercisable at $0.13 each;

- Tribeca as a strategic shareholder, is investing these funds to commence well-field development and further exploration on the Ngami ISCR project;

- Three other Cobre Botswana projects are fully funded by partners, BHP and Sinomine, and are separate from the Ngami project, with ongoing exploration; and

- Tribeca appointed as strategic advisor to advise Cobre on its copper offtake and debt funding requirements for the Ngami ISCR project.

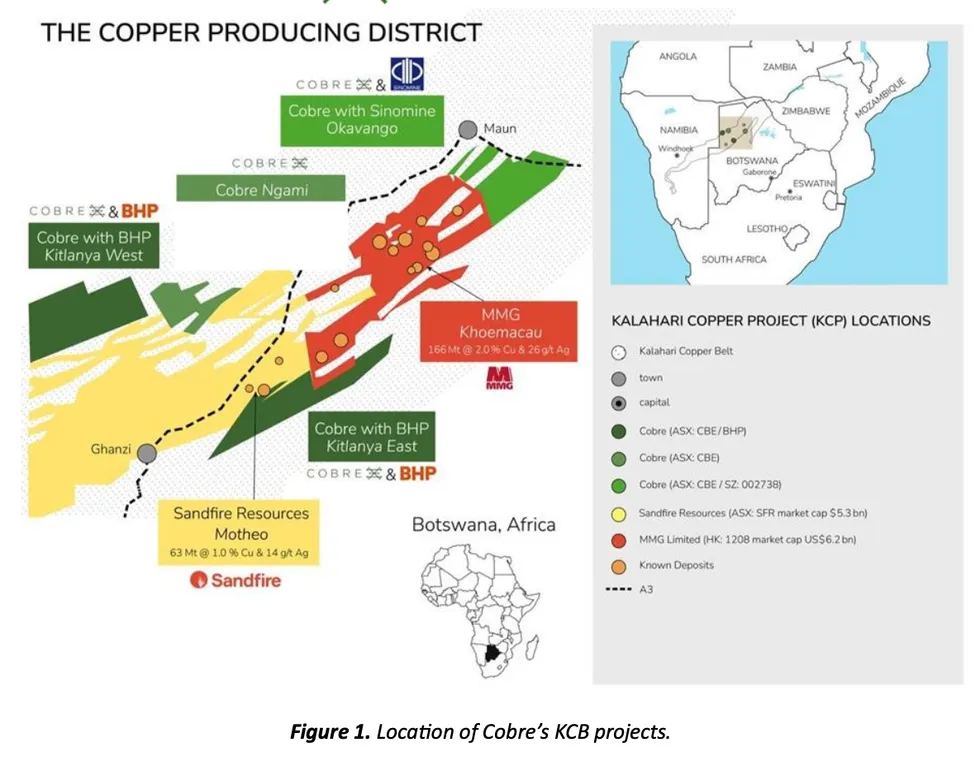

Tribeca’s strategic investment is an important milestone for the Company as it looks to progress development of an In-Situ Copper Recovery (ISCR) demonstration plant on the Ngami Copper Project (Ngami or NCP) in the Kalahari Copper Belt (KCB), Botswana. The investment follows an extensive investment due diligence process with the proceeds from the Placement, together with existing cash, allocated for well-field development ahead of construction of the demonstration plant, and to accelerate further exploration on the NCP.

It is anticipated that the demonstration plant will be funded with copper and silver offtake and debt. Tribeca have indicated their support for this project and future copper offtake and debt funding of the Ngami development plant. Tribeca have entered into an advisory agreement to support this project for copper offtake and debt funding.

Construction of the demonstration plant is planned to commence following completion and approval of an Environmental Impact Assessment which is currently in progress (see ASX announcement 15 October 2025).

In addition to NCP, work programmes on Cobre’s three other projects, which are fully funded by partners BHP and Sinomine, are ongoing (see ASX Announcements 10 March 2025 and 2 September 2025).

Welcoming Tribeca as a strategic investor to Cobre, Martin Holland, Cobre’s Executive Chairman, said:

“Every now and again along comes an amazing opportunity to bring in a strategic aligned shareholder. Today, we are pleased to have that with Tribeca. Tribeca not only did their homework in the extensive due diligence before agreeing to be our strategic investor and advisor for the Ngami ISCR project; they bring solid gravitas in the resource sector as a reliable long-term partner to help build mining projects and make them a reality.

Further to the strategic equity investment today, Tribeca have entered into an advisory agreement to support the Ngami ISCR project for copper offtake and debt funding.”

Tribeca, commenting on their investment in Cobre, Ben Cleary, Tribeca’s PM of the Global Natural Resource Fund, said:

“We have been really impressed with the Cobre management team and the suite of copper projects that Cobre has been advancing in the Kalahari Copper Belt. We know that Sandfire Resources and MMG have built-up impressive copper production in the Kalahari Copper Belt. Botswana is a solid jurisdiction in Africa with good people, infrastructure, Government and history of mining project development.

Tribeca follows the recent ISCR project, Florence Copper owned by Taseko Mines, and their recent financing of a US$173m investment at a market capitalisation of US$1.5bn. With the goal of becoming the next ISCR upcoming copper producer, we believe this is an important market benchmark for Cobre.

Tribeca is pleased to have made a strategic investment in Cobre which will be used to accelerate exploration and development on Cobre’s ISCR Ngami Project in the Kalahari Copper Belt in Botswana and, in particular, to support helping make this next copper producer a reality.”

PLACEMENT DETAILS

The Placement was conducted at a price of A$0.10 per New Share, which represents a premium of:

- 8.7 % premium to the last close price of $0.092 on 13 November 2025;

- 7.8% premium to the 5-day Volume Weighted Average Price (VWAP) of $0.093; and

- 11.4% premium to the 10- day VWAP of $0.090.

The Placement also comprises a 1 for 1 free attaching option exercisable at $0.13 each and expiring 15 January, 2029 (Attaching Options) with the Attaching Options subject to the approval of shareholders at an Extraordinary General Meeting of the Company expected to be held in January 2026 (EGM).

All New Shares issued under the Placement, together with any new shares issued upon the exercise of the Attaching Options, will rank pari passu with the existing ordinary shares on issue in the capital of the Company.

Defender Asset Management acted as Lead Manager to the Placement.

Click here for the full ASX Release

This article includes content from [Company Name], licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Read the full article here