The precious metals market is in the midst of a powerful upswing. The gold price continues to surge, silver has reached its highest levels in over a decade, and copper has seen renewed investor interest on the back of long-term supply deficit forecasts.

These moves have set off a chain reaction across the mining investment spectrum.

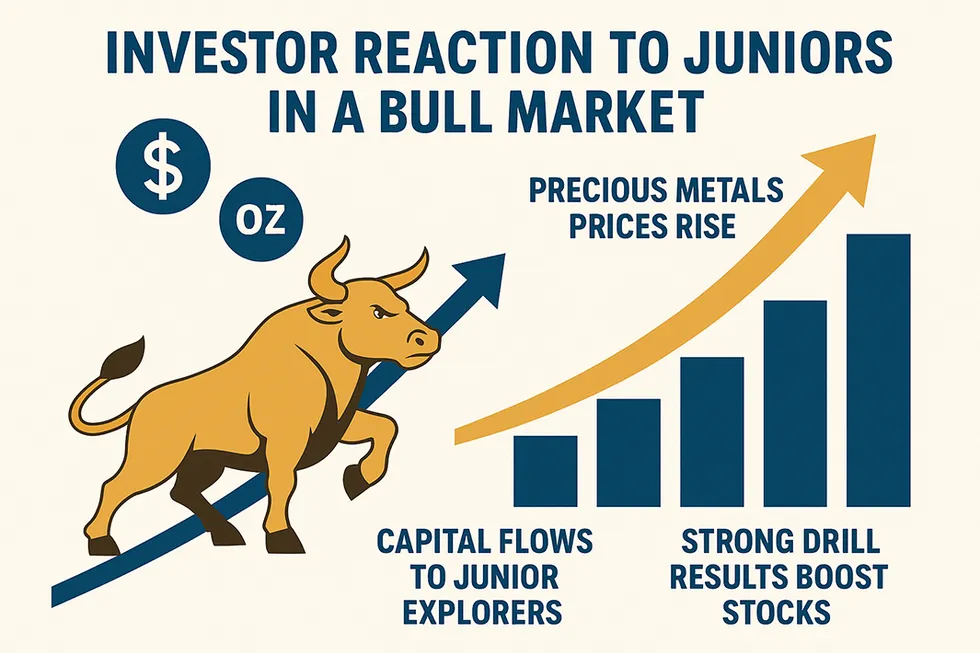

In a rising precious‑metals environment, the initial beneficiaries are the senior producers, whose revenues rise quickly as metal prices move higher. As their valuations improve, however, capital tends to flow down the chain to junior exploration companies, which offer the greatest leverage to a bullish market.

Spotlight on juniors

Junior explorers are relatively small, agile companies focused on discovery rather than production. With valuations tied almost entirely to exploration potential, they tend to be more volatile, but in a bull market, that volatility often works in their favour. Strong commodity prices make it easier to raise capital, the market places a premium on drill results, and well-funded majors are more inclined to acquire promising deposits to replenish reserves.

Historical cycles show that juniors have significantly outperformed larger peers during sustained uptrends, delivering more than double the average annual return, albeit with greater risk.

This dynamic is currently playing out in the market.

Petratherm (ASX:PTS) has seen a 680 percent increase in its share prices over a one-year period as of September 2025, following a major titanium discovery at its Rosewood deposit.

Harvest Gold’s (TSXV:HVG) stock price climbed from the mid-$0.05 range to about $0.14 after launching a 5,000 meter diamond drill program in June 2025 at its Mosseau gold project in Québec, where it has identified 15 primary and 10 secondary drill targets following government approvals. These gains underscore the multiplier effect of a strong metals market combined with meaningful exploration news.

Not all juniors are created equal

Despite headline-grabbing gains, not all juniors are benefitting equally. A significant portion remains constrained by limited treasury, a crowded market and execution risk.

This is why selectivity is critical. Well-funded juniors with strong assets, clear drill plans and proven technical teams are positioned to capture disproportionate gains when catalysts hit.

Equity Metals: Positioned to outperform

Equity Metals (TSXV:EQTY,OTCQB:EQMEF) is one such example. The company’s flagship Silver Queen project in BC is a high-grade, district-scale silver-equivalent asset. When Equity assumed management, it identified clear opportunities to expand the resource, prioritizing targets with the greatest potential impact.

A December 2022 NI 43-101 resource update validated that approach, boosting the resource to 62.8 million silver-equivalent (AgEq) ounces indicated at an average grade of 565 grams per ton (g/t) AgEq, and 22.5 million ounces inferred at 365 g/t AgEq, based on a C$100 per ton NSR cut off and conservative long-term metal prices.

The 2025 drill program continues to return strong results from the No. 3 North target, including 1.3 meters of 1,128 g/t AgEq with a 0.7-meter interval grading 2,042 g/t AgEq (SQ25-160), and 1.7 meters of 910 g/t AgEq with a 0.4-meter interval of 2,687 g/t AgEq (SQ25-164). These new intercepts extend the No. 3 Vein to depths of roughly 450 meters and up to 650 meters along strike, confirming continuity of high-grade mineralization beyond the 2022 resource model.

Beyond No. 3, the Silver Queen property hosts more than 20 identified epithermal veins across a 6 sq km area, most of which remain underexplored. Equity Metals has also completed reconnaissance soil and stream-sediment sampling to advance multiple district-scale targets in preparation for potential drill testing in 2026.

The company’s Arlington project, also in BC, is a district-scale gold-copper-silver property with multiple targets analogous to historically productive mines. In a strong metals market, Arlington offers diversification and optionality, with drilling underway and assays pending. Both projects are backed by fully funded 2025 exploration programs, allowing the company to advance aggressively without immediate financing pressure.

Equity Metals’ progress shows how a focused strategy, strong technical execution, and disciplined capital use can unlock significant value from high-grade assets. With multiple targets set for drilling this year and a resource update ahead, the company is positioned to benefit from both project-level advancements and the broader bull market tailwinds.

Investor takeaway

The current precious metals bull market is creating fertile ground for junior explorers. Capital is rotating into higher-beta names, financings are increasing, and discovery stories are being rewarded with rapid re-ratings.

Companies like Petratherm and Harvest Gold illustrate the upside potential, but Equity Metals — with its high-grade Silver Queen resource, district-scale Arlington project, and active drill programs — offers a compelling example of a junior positioned to ride the wave.

For investors, the lesson is clear: in a bull market, the right junior can deliver leveraged exposure to rising metals prices when backed by geological quality, execution discipline, and timely catalysts.

This INNSpired article is sponsored by Equity Metals (TSXV:EQTY,OTCQB:EQMEF,FWB:EGSD). This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by Equity Metals in order to help investors learn more about the company. Equity Metals is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Equity Metals and seek advice from a qualified investment advisor.

Read the full article here