Is Rocket Money the best budgeting app? In this Rocket Money review, we examine its features like budgeting tools and subscription management to see if it’s worth your time.

Key Takeaways

Rocket Money (formerly Truebill) is a budgeting app that helps users track spending, set budgets, and manage subscriptions with an easy-to-use interface.

Key features include automated subscription management, personalized spending insights, and a bill negotiation service that can save users money, albeit with fees.

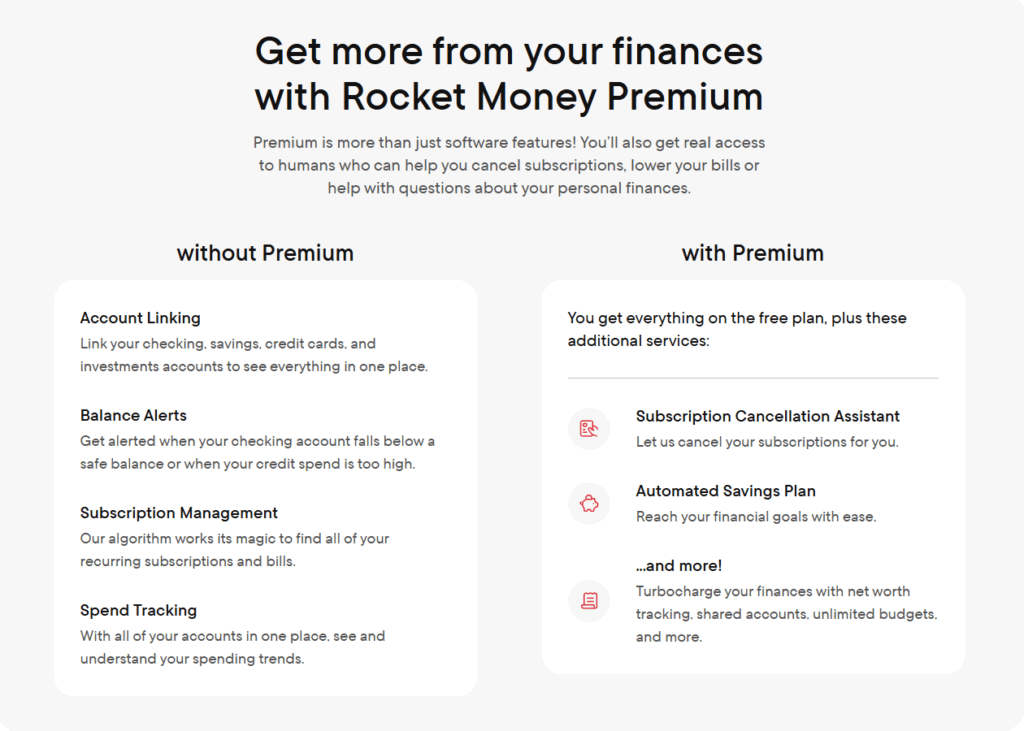

While it offers a free plan, premium features range from $6 to $12 per month and enhance budgeting capabilities and savings tools.

What is Rocket Money?

Rocket Money is a money management and budgeting app designed to help users take control of their finances. The rocket money app facilitates tracking spending, setting budgets, and managing subscriptions, all through a user-friendly interface. Whether you’re trying to save for a rainy day or simply want to track your spending habits, Rocket Money free aims to make the process seamless.

Originally known as Truebill, Rocket Money was rebranded in August 2022 after being acquired by Rocket Companies in 2021. This rebranding brought a host of new features and a refreshed interface that makes financial management more intuitive. With its color-coded spending categories and comprehensive subscription management tools, Rocket Money offers a clear and organized way to handle your personal finances.

How Does Rocket Money Work?

To get started with Rocket Money, users must link at least one bank account using the secure service Plaid, which supports most U.S. banks and credit card issuers. The setup process is quick, taking less than 10 minutes to create an account and sync your financial data.

Once linked, Rocket Money consolidates all your financial information, offering a real-time, comprehensive view of your balances, bills, and spending patterns to give you the full picture through account syncing.

Stop overpaying and start saving. Try Rocket Money’s free plan and see how much you can cut from your monthly bills.

Subscription Management

One of Rocket Money’s standout features is its subscription management tool. The app:

Scans your transactions for recurring charges in about 30 seconds

Provides a detailed list of your subscriptions

Is particularly beneficial for those who have multiple subscriptions and want to avoid unwanted charges

Allows users to cancel subscriptions directly within the app with just a single tap, making the process incredibly convenient.

For individuals who prefer a hands-off approach to manage subscriptions, Rocket Money’s subscription management tool is a game-changer. It effectively identifies and helps eliminate unwanted subscriptions, giving users better control over their financial landscape.

Budgeting Tools

Rocket Money’s budgeting tools are designed to help users save money and achieve their financial goals. The best budgeting app automatically averages your monthly income to set budget baselines, which can be customized to better align with your personal finance needs. However, to create unlimited budgets and fully customize categories, you’ll need to upgrade to the premium version. Budgeting apps can also enhance your experience by providing additional features.

One of the key access features is the app’s ability to automatically monitors your budgets by providing alerts for overspending in specific categories. This real-time tracking is made possible through seamless integration with your bank accounts and checking account, offering the same features for an accurate and up-to-date picture of your financial health.

Despite its many advantages, Rocket Money’s budgeting tools are not without flaws. Transactions may occasionally be miscategorized, which could affect the accuracy of your budgets. However, the app’s intuitive interface and straightforward navigation make it a favorite among users who appreciate its ease of use.

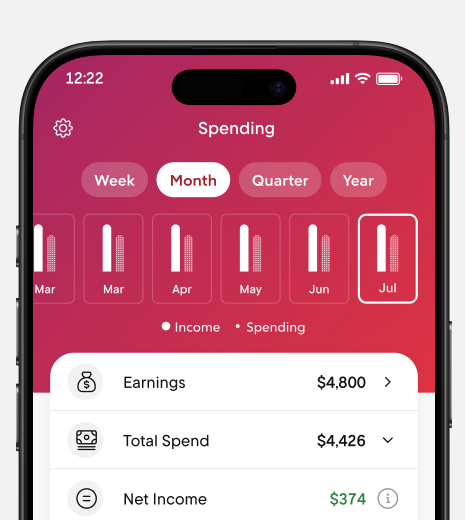

Spending Insights

Rocket Money goes beyond basic budgeting by offering personalized financial insights. These insights help users evaluate their spending habits and identify top spending categories, including their spending category. This feature is particularly useful for those looking to make informed decisions about how they spend their finances and save money in the long run.

Additionally, Rocket Money offers refunds on bank overdrafts or late fees, adding another layer of financial benefits for users. These spending insights and financial perks make Rocket Mortgage Money a valuable tool for anyone serious about improving their financial health.

Bill Negotiation Service

Rocket Money’s bill negotiation service is designed to help users save on their existing bills by negotiating better rates with providers. The app flags bills for potential savings, such as switching to a cheaper cell phone or cable plan. While this service can lead to significant savings, it comes with a fee ranging from 35% to 60% of the savings achieved.

It’s important to note that users do not keep all the savings from bill negotiations, which may only apply to the first year’s savings. Despite this, the potential for year’s savings—such as $175 saved over the next year—makes this feature worth considering.

Smart Savings Account

Rocket Money offers an automated savings feature through its Smart Savings tool, which:

Helps users save money effortlessly

Moves money to a savings account based on user habits

Makes it easier to reach financial goals without constant attention

Users can set specific savings goals and input monthly savings contributions in Rocket Money’s financial goals section to help them save more spend less. This automated approach to financial planning and saving ensures that users can achieve their money goals with minimal effort.

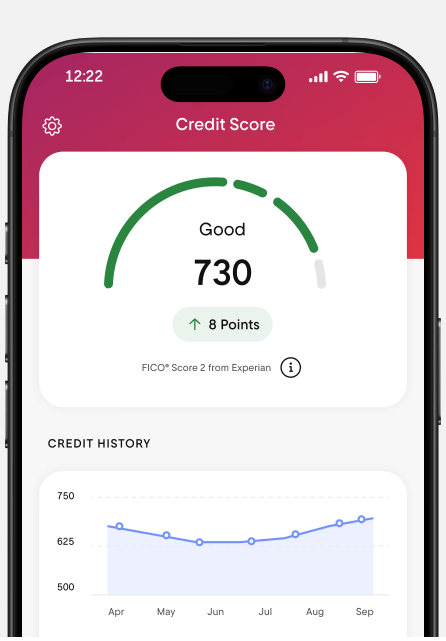

Credit Score Tracking

Rocket Money also offers a credit report monitoring feature, providing users with regular updates on their credit health. This feature allows users to monitor changes in their credit score over time, helping them stay informed and make better financial decisions.

Join the millions already using Rocket Money to budget smarter, cancel unused subscriptions, and reach their money goals faster.

Rocket Money Cost

Rocket Money offers a flexible cost structure that includes a free plan with limited features and a premium subscription ranging from $6 to $12 per month. The free version provides basic budgeting capabilities and transaction visibility but lacks the advanced tools needed for a comprehensive budgeting experience.

The premium membership unlocks additional functionalities like unlimited custom budget categories and automated savings options. Users can also access a seven-day free trial to explore Rocket Money’s premium features before committing.

Is Rocket Money Safe?

When it comes to safety, Rocket Money employs AES 256-bit encryption to secure personal data. This ensures that user data is encrypted both in transit and at rest, preventing unauthorized access. Additionally, Rocket Money uses industry-standard security protocols to further enhance data protection.

The app uses Plaid to securely connect bank accounts, transmitting banking credentials securely and enhancing user trust. Rocket Money also guarantees up to $250,000 in FDIC insurance for the savings accounts it manages, providing an extra layer of security for users.

Importantly, Rocket Money does not store user login credentials, further ensuring data safe.

Who Should Use Rocket Money?

Rocket Money is ideal for a wide range of budgeters looking to manage their finances more effectively. The money app simplifies financial management by providing a comprehensive overview of spending and savings. Users can also benefit from the app’s subscription management features, which help negotiate various bills such as cell phone and cable, making it a valuable tool for a thorough money review. Additionally, rocket money’s features enhance the overall user experience.

Overall, if you’re seeking a comprehensive budgeting app and a tool for effective subscription management, Rocket Money is worth considering.

Alternatives to Rocket Money

While Rocket Money is a robust budgeting tool, there are other apps worth considering. Monarch Money and You Need a Budget (YNAB) are two popular alternatives. Monarch Money offers visual finance displays that help users manage their budgets effectively.

YNAB, on the other hand, allows users full control and manual tracking of their finances. Both apps provide distinct features that cater to different budgeting needs, making them viable alternatives to Rocket Money.

User Reviews and Ratings

Rocket Money has received an average rating of approximately 4 stars across various platforms, with the Apple App Store rating being 4.3 stars. Users find the app user-friendly, with a clean design that makes budgeting easier.

However, some users have criticized the Bill Negotiation tool for its high fees and inflated savings estimates. Despite these criticisms, the overall user feedback is positive, making Rocket Money a reliable choice for many.

Summary

Rocket Money offers a comprehensive suite of tools for managing personal finances, from budgeting and subscription management to bill negotiation and credit score tracking. The app’s user-friendly interface and secure data practices make it a compelling option for anyone looking to take control of their financial health.

Whether you’re a seasoned budgeter or just starting, Rocket Money provides the features and flexibility needed to achieve your financial goals. Give it a try and see how it can transform your approach to managing money.

Ready to see where your money’s really going? Sign up for Rocket Money and uncover your true spending picture today.

FAQs

Rocket Money has a free plan with basic features, but if you want more, the premium subscription costs between $6 to $12 a month.

Absolutely, Rocket Money is safe to use since it uses AES 256-bit encryption and doesn’t store your login info. You can feel secure while managing your finances!

Absolutely, you can easily cancel subscriptions right in the Rocket Money app with just a tap! It’s super simple and handy.

Yes, Rocket Money has a seven-day free trial for its premium features, so you can check it out risk-free!

Top U.S. Brokers of 2025

★ ★ ★ ★ ★

★ ★ ★ ★ ★Features:

✅ U.S. stocks, ETFs, options, and cryptos✅ Now 23 million users✅ Cash mgt account and credit card

Sign-up Bonus:

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Learn more

★ ★ ★ ★ ★

★ ★ ★ ★ ★Features:

✅ Free Level 2 Nasdaq quotes✅ Access to U.S. and Hong Kong markets✅ Educational tools

Sign-up Bonus:

Deposit $100, get $20 in NVDA stock; Deposit $2,000, get $50 in NVDA stock; Deposit $10,000, get $300 in NVDA stock; Deposit $50,000, get $1,000 in NVDA stock

Learn more

★ ★ ★ ★ ☆

★ ★ ★ ★ ☆Features:

✅ Access 150+ global stock exchanges✅ IBKR Lite & Pro tiers for all✅ SmartRouting™ and deep analytics

Sign-up Bonus:

Refer a Friend and Get $200

Learn more

View Full List

★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆