Stocks Poised for Promising Returns Amid Volatility Drop and Late-Hour Buying: SentimenTrader

Over the past two weeks, traders have actively snapped up stocks in the final trading hour, coinciding with a sharp decline in the Cboe Volatility Index (VIX), often referred to as Wall Street’s “fear gauge.” This combination of factors has historically signaled favorable conditions for the stock market, according to Dean Christians, senior research analyst at SentimenTrader, in a recent note.

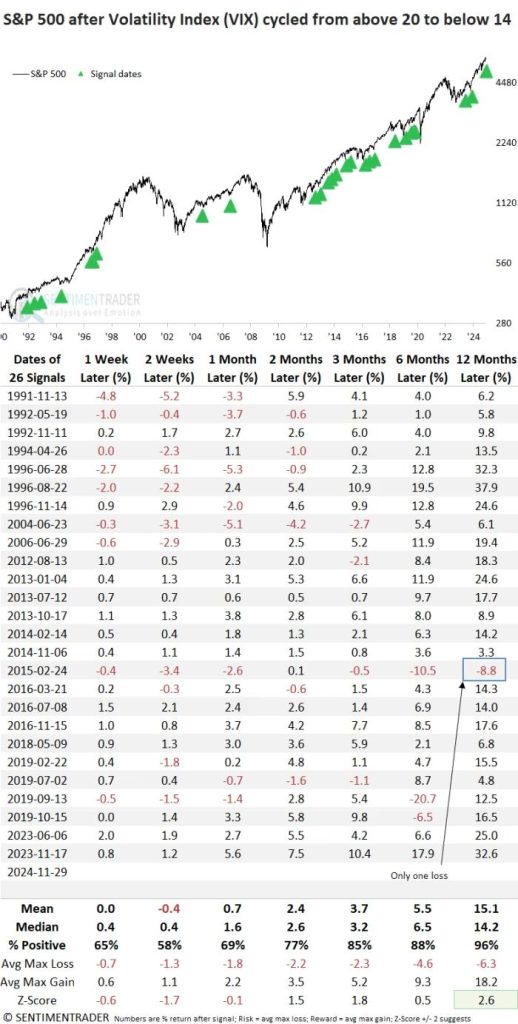

VIX Drops Below Key Threshold

The VIX, which measures expected S&P 500 volatility over the next 30 days, closed below 14 on Friday for the first time in four months. This marked a significant decline from its August highs above 20 during a brief market pullback. Historically, when the VIX falls below 14 after surpassing 20, the S&P 500 has delivered strong medium- and long-term returns.

Christians pointed out that in 26 past instances of such a VIX move, the S&P 500 rose a year later 96% of the time, with a median gain of 14.2%. The sole exception was in 2015. Following similar conditions in late 2023, the index gained 10% over the subsequent three months.

Last-Hour Buying as a Bullish Indicator

SentimenTrader’s last-hour trading indicator, which tracks the direction of final-hour activity, has risen in nine of the past 10 sessions. This pattern suggests heightened trader confidence and aligns with the “upward drift” commonly seen in bullish markets.

Historically, when the S&P 500 was within 2% of its all-time high and this indicator rose in nine out of 10 sessions, the index advanced 90% of the time over the next six months. Over a shorter three-month horizon, gains occurred 81% of the time, with an uninterrupted streak of 14 gains dating back to 1995.

Echoes of the 2016 Election

The current environment mirrors conditions following the 2016 presidential election, when both the VIX drop and last-hour buying signaled a constructive market setup. Back then, stocks rallied into December before consolidating and resuming their upward momentum.

Market Outlook

The S&P 500 ended November with a 5.7% monthly gain and has surged nearly 27% year-to-date, with its record-breaking rally showing signs of continuation.

Christians concluded that the alignment of bullish indicators, including the VIX decline and last-hour buying interest, points to a favorable environment for stocks. Despite the typical volatility seen during uptrends, the evidence remains strongly in favor of the bulls.