James Wellesley stood before a judge in Brooklyn on Oct. 7 and pleaded guilty to wire fraud conspiracy. The conspiracy in question? Wellesley and fellow defendant Stephen Burton had been accused of taking $99.4 million from investors in an elaborate Ponzi scheme. The two British men claimed the money would be used for high-interest loans to wealthy investors in need of quick capital. The loans would be backed by rare collectible wines, which would be sold if the investors failed to pay back the loans.

The problem was, those wines never existed. Neither did the borrowers supposedly taking out the loans. Instead the money went into Burton and Wellesley’s pockets; they used the money for their own expenses and to pay some “interest” to their investors. Both men now face a decade or more in prison.

Loans Backed by Imaginary Screaming Eagle

Burton and Wellesley, who also used the name Andrew Fuller, started showing up at investor conferences a decade ago, claiming to be executives of a wine brokerage, Bordeaux Cellars, based in London and Hong Kong. They told potential investors they could lend money to wealthy borrowers who needed fast loans, no questions asked. The lenders would receive interest at the rate of 12 percent, paid quarterly.

“Lots of customers now are property developers who are short of cash,” said Wellesley at a 2017 conference in Las Vegas.

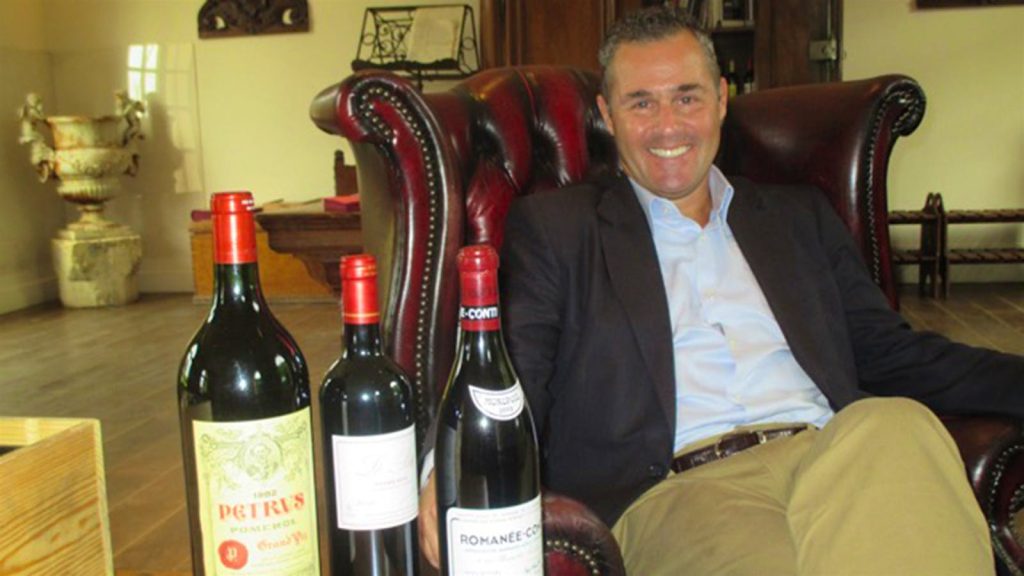

[article-img-container][src=2025-10/ns_burton-sauternes-102225_1080.jpg] [credit= ] [alt= Stephen Burton poses with a large-format bottle of Sauternes.][end: article-img-container]

Normally, such a high rate of interest meant that the loan would be risky. But the men claimed these loans would be secured with prestigious wines from the borrowers’ cellars, stored in climate-controlled warehouses overseen by Bordeaux Cellars. “What happens in case of a default?” asked Burton at a 2015 conference in Cancun. “We sell the wine, bearing in mind that you’ve loaned only 35 percent of the value of it. It’s very easy to sell quite quickly.”

The men appeared confident—Burton even went on CNBC to explain how he had thought of the investment vehicle. But behind the scenes, they were creating dozens of shell companies where the investors’ money was deposited. These were supposedly the borrower’s companies, but they actually belonged to Burton and Wellesley. Some payments were made to investors, but these apparently came from new clients’ deposits. Investors trying to learn more information called the firm’s number to discover no such firm existed. And then in 2019, all payments stopped.

Arrests, Extradition and Now Conviction

Burton was arrested by British police in February 2019 in a hotel in Kent. In his room, the police found two fake passports, expensive watches, bars of precious metals and South African and British currency with a total value of almost £1 million. He pleaded guilty to possession of fake passports and money laundering and was sentenced to four years in prison. Before U.S. authorities could bring charges, he was released in 2020, apparently due to Covid concerns, and disappeared. He was arrested in Morocco in 2022, federal prosecutors say, when he tried to enter the country using a fake Zimbabwean passport, then extradited to the U.S.

Wellesley was arrested in the U.K. in 2022 and finally extradited to New York in July 2025. He pleaded not guilty that month to three charges, but around the same time, Burton came to an agreement with prosecutors and pleaded guilty to wire fraud conspiracy and money laundering conspiracy. Burton admitted to U.S. District Judge Pamela Chen that rather than controlling a cellar of 25,000 bottles of rare wines from producers like Domaine de la Romanée-Conti and Screaming Eagle, as they claimed, he and Wellesley never had more than 217 bottles in their cellar.

As part of the plea deal, Wellesley will have to give up $1 million in profits from the scheme, plus funds in more than two dozen bank accounts and any wines he had in storage. He is facing 10 to 12 and a half years in prison at his Feb. 3, 2026, sentencing hearing, under recommended federal guidelines. Burton will be sentenced on Jan. 6, 2026, and faces 24 to 29 years in prison. He has agreed to forfeit $26 million from the scheme.

Stay on top of important wine stories with Wine Spectator’s free Breaking News Alerts.