In the first quarter of 2025, the aggregate net asset value of non-traded business development companies crossed the $100 billion threshold for the first time, reaching $106.4 billion as of March 31, 2025. Just a year ago, the aggregate NAV of non-traded BDCs was $68.6 billion, a year-over-year increase of 55.1%. This is according to the latest analysis by Robert A. Stanger & Company, Inc., an investment banking firm and leader in alternative investment industry research.

Non-traded BDCs have now had 11 consecutive quarters of positive total returns, returning 1.8% for the quarter and 9.5% over the past year. In comparison, traded BDCs recorded a three-month return of 0.9% and a one-year return of 11%; however, the recent market volatility surrounding “Liberation Day” led to a 6.7% decline for traded BDCs last month.

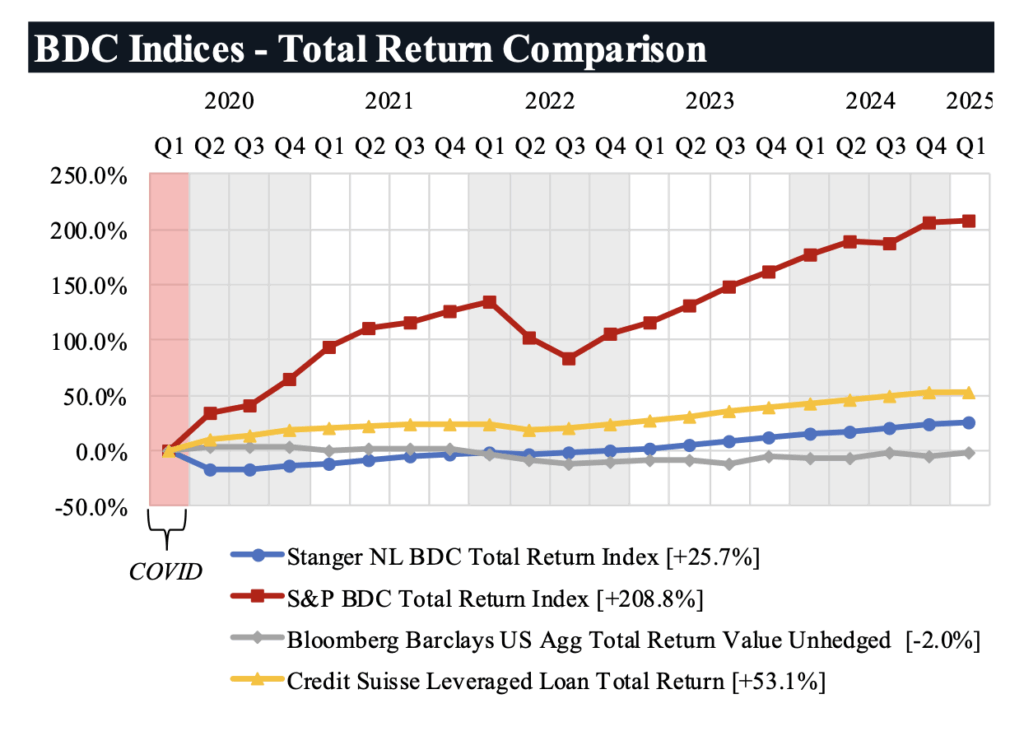

“Non-traded BDCs continue to deliver investors steady returns, particularly during turbulent periods, sharply contrasting the volatility seen by their public counterparts across recent and historical market conditions,” said Kevin T. Gannon, chairman and chief executive officer of Robert A. Stanger & Company Inc. “This disparity has been evident over the past five years, from the dramatic Q1 2020 downturn to a significant correction in 2022, and most recently with the turbulence of April this year.

PGIM Private Credit Fund led the non-traded BDC market in Q1 2025, topping both the three-month (3.4%) and one-year (14.2%) total return rankings for the second consecutive quarter. For longer-term performance, HPS Corporate Lending Fund narrowly edged last quarter’s three-year returns leader, Blue Owl Credit Income Corporation, while Blue Owl Capital Corp. II remained atop the five-year total return rankings.

“All 22 non-listed BDCs delivered positive one-year total returns through Q1 2025, with all but one achieving positive quarterly total returns to start the year,” said Gregory R. DiSalvo, managing director at Robert A. Stanger & Co. “Significant market developments for the first quarter include Antares Private Credit Fund going effective in February, MSC Income Fund’s successful [New York Stock Exchange] listing on Jan. 29, and FS Specialty Lending Fund’s planned NYSE listing by year-end 2025.”

“Clearly the resilience of non-traded BDCs has fueled investor confidence, propelling the space past $100 billion in NAV and pacing toward $48 billion in capital formation for 2025,” concluded Gannon.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.

Click here to visit the AltsWire directory page.

Read the full article here