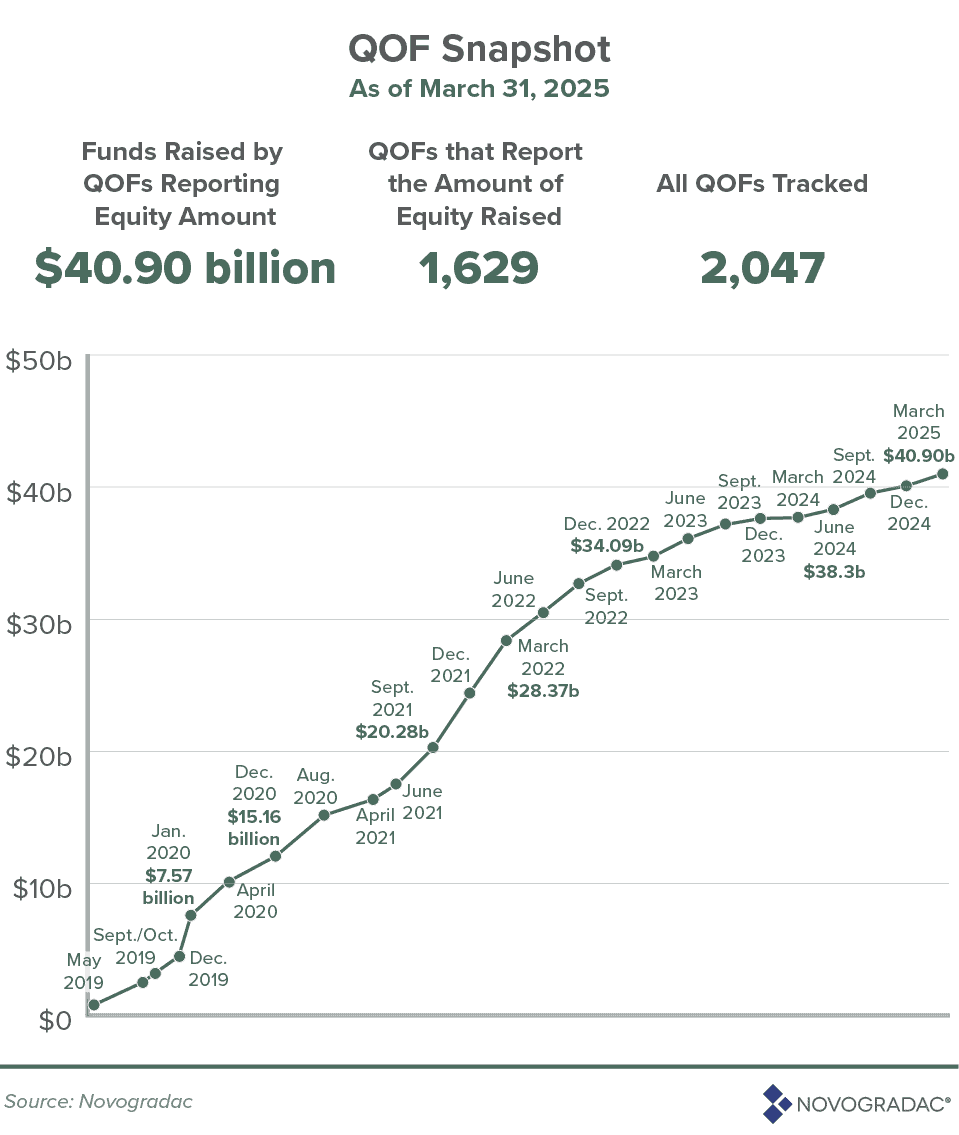

Qualified opportunity zone funds experienced a robust first quarter in 2025, attracting an additional $810 million in equity, according to the latest data tracked by Novogradac – a certified public accounting, valuation, and consulting organization that specializes in federal tax incentives.

This marks the second-largest quarterly equity raise for these funds since the third quarter of 2023, according to the firm..

Since the inception of the opportunity zone incentive in 2018, QOZ funds tracked by Novogradac have now accumulated a total of $40.90 billion in equity. Novogradac currently monitors 2,047 QOZ funds, with 1,629 of them reporting specific equity amounts.

Novogradac’s data collection is ongoing and relies on voluntary reporting from QOZ funds, supplemented by information from public sources like U.S. Securities and Exchange Commission filings. Novogradac’s figures do not encompass proprietary or private funds managed by their principal investors, leading to industry estimates suggesting the actual total OZ investment could be up to three times greater.

The significant $810 million equity influx in the first quarter of 2025 arrives at a crucial juncture. Congress is currently considering potential tax legislation that could include extensions or the permanent establishment of the OZ incentive. Additionally, the looming Dec. 31, 2026, deadline, after which capital gains will no longer be eligible for OZ benefits, is likely influencing investment decisions.

A recent report from the White House Council of Economic Advisers projected that extending opportunity zone tax incentives beyond their scheduled 2025 expiration could drive more than $100 billion in new investment into economically distressed communities.

Of the $40.09 billion in equity raised by the end of March, Novogradac has identified planned investments for $31.07 billion. Consistent with previous trends, residential properties continue to dominate OZ investment. Exclusively residential projects account for $14.27 billion (45.9%) of identified investment, while projects including housing represent a substantial $24.02 billion (77.3%). Within the housing sector, multifamily properties attract the lion’s share at $21.96 billion, with $3.18 billion specifically targeting affordable housing developments.

Nationwide, QOZ funds tracked by Novogradac report financing 199,280 homes across 238 cities through the OZ incentive. Notably, nine cities have witnessed the development of over 5,000 OZ-financed homes, 51 cities have at least 1,000, and 182 cities have at least 100 such homes.

Investment in exclusively commercial properties accounts for $3.88 billion of the total identified investment. Other sectors, including renewable energy, hospitality, and operating businesses, each constitute less than 5% of the total investment.

The top 10 cities and states for planned investment have remained consistent since the end of 2024, with Los Angeles, Washington, D.C., and New York City leading the cities list, and California, Arizona, and New York maintaining their positions as the top three states.

Novogradac’s analysis also reveals the distribution of equity raised among different-sized QOZ funds. The 13 largest QOZ funds, each having raised at least $500 million (with three exceeding $1 billion), account for 26.6% of all equity raised. In contrast, the 1,083 smaller funds, which constitute 66.5% of all QOZ funds reporting equity and have raised $10 million or less, account for 7.3% of the total equity. Novogradac suggests that the prevalence of these smaller funds, often focused on single developments, underscores the OZ incentive’s effectiveness in financing both large-scale national investments and targeted local projects. The median equity raised by a single-asset QOZ fund is $3.6 million, while multi-asset funds have a median equity of $14.8 million.

Click here to visit the AltsWire directory page.

Read the full article here