AmeriTrust Financial Technologies (TSXV:AMT,OTCQB:AMTFF,Frankfurt:1ZVA) is a publicly traded fintech company focused on the US$1.6 trillion US automotive finance market. The company has built a proprietary, cloud-based platform that enables vehicle leasing and financing, asset servicing, and remarketing. AmeriTrust’s technology seamlessly connects dealers, consumers, and funding partners through an integrated digital workflow that automates underwriting, approvals, documentation, and funding.

Although AmeriTrust supports both loan and lease products, its primary strategic focus is used-vehicle leasing—a segment that remains largely untapped in the US market. Leasing accounts for roughly 25 percent of new vehicle transactions, yet represents less than 2 percent of used-vehicle sales, which are mostly limited to OEM-certified programs.

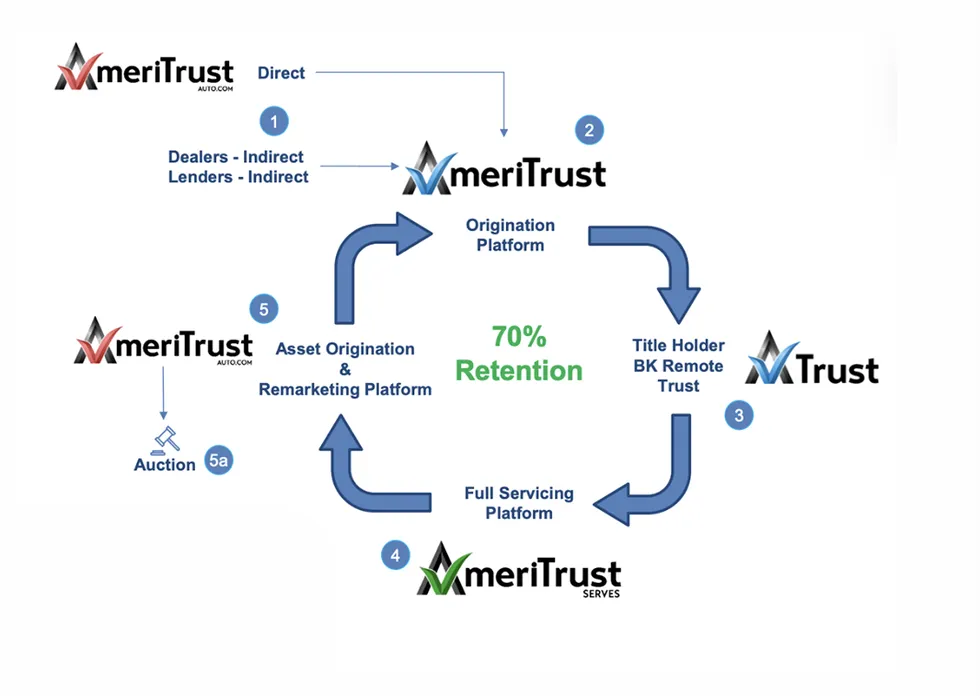

AmeriTrust positions used-vehicle leasing as a more affordable alternative to traditional retail financing, delivering lower monthly payments and reduced upfront costs for consumers, while unlocking incremental sales opportunities for dealers and compelling risk-adjusted returns for lending partners. Its integrated platform enables the company to capture value across the entire asset lifecycle, rather than depending on a single revenue point.

Company Highlights

- Proprietary fintech platform purpose-built for new and used vehicle leasing, servicing and remarketing

- Strategic focus on used-vehicle leasing, a segment with limited competition compared to new-vehicle leasing

- Licensed across the U.S.

- Proprietary technology integrated into major dealer ecosystems, enabling rapid decisioning and funding

- Management team with decades of experience in specialty auto finance, capital markets and platform scaling

This AmeriTrust Financial Technologies profile is part of a paid investor education campaign.*

Click here to connect with AmeriTrust Financial Technologies (TSXV:AMT) to receive an Investor Presentation

Read the full article here