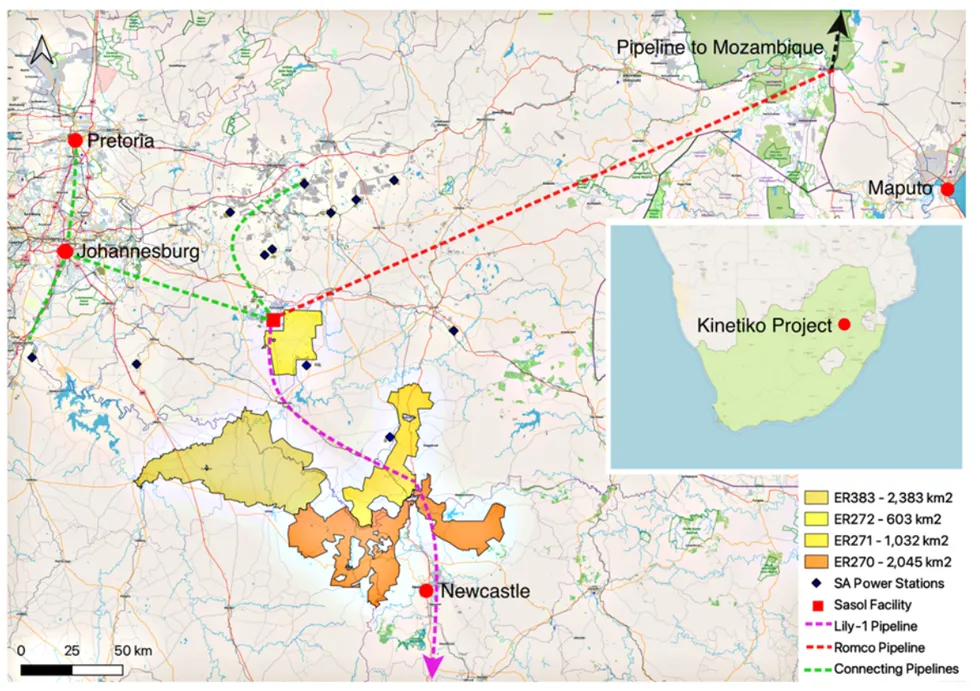

Kinetiko Energy (ASX:KKO) is an onshore gas exploration and development company targeting the commercialisation of shallow conventional gas resources in South Africa’s Mpumalanga Province. Its exploration assets are strategically located near ageing coal-fired power stations and existing energy infrastructure, enabling Kinetiko to deliver gas to a domestic market grappling with persistent power shortages and seeking cleaner, more reliable alternatives to coal-based electricity.

The company has secured its first gas reserves with strong economic potential and has announced 6 Tcf of 2C contingent resources, creating a substantial onshore gas project with considerable growth potential. Kinetiko is advancing a phased development plan through Project Alpha, supported by a binding Joint Development Agreement with FFS Refiners. The management team combines extensive local operational knowledge, capital markets expertise, and decades of experience in energy and infrastructure, positioning Kinetiko to transition from explorer to gas producer.

The Brakfontein gas project is Kinetiko Energy’s most advanced gas field in South Africa. Situated in Mpumalanga Province, it consists of a cluster of seven shallow conventional gas wells strategically located near existing energy infrastructure and key power demand centres.

Company Highlights

- Advancing a world-class onshore gas project with 6 trillion cubic feet (Tcf) of 2C contingent resources and maiden gas reserves with positive economics

- Strong extended flow test results from production test wells at Brakfontein, with methane purity exceeding 98.5 percent

- Additional exploration acreage to grow current contingent resources and reserves

- Binding Joint Development Agreement with FFS Refiners to co-develop a staged LNG project, starting with a 5,000-tonne-per-annum (tpa) pilot plant

- Located in South Africa’s primary power-producing region, close to existing infrastructure and major demand centres

- Clear pathway from exploration to production, supported by recent funding, reserve certification work and production right applications

This Kinetiko Energy profile is part of a paid investor education campaign.*

Click here to connect with Kinetiko Energy (ASX:KKO) to receive an Investor Presentation

Read the full article here